Issue #48: Owning the Infrastructure - Part 2

Two weeks ago I wrote “Owning the Infrastructure: Part 1” about the value proposition of controlling public blockchain and DeFi infrastructure, and how surprised I was that traditional financial institutions weren’t making a play for this.

My argument was simple - (a) blockchains and DeFi protocols are global, asset-agnostic infrastructure, and (b) they collect fees for hundreds of transaction types.

I think being global, asset agnostic infrastructure is pretty straightforward. As long as an asset is in token form, blockchains can support it. They also give an asset immediate global reach, which is a grossly underestimated benefit.

The second part of the argument though - supporting different types of transactions - was something I wanted to explore further, I just didn’t have the data.

I mentioned that if I found a good breakdown of Ethereum gas fees by transaction type I would write a follow up diving into the numbers. Well someone from the community answered the call, and no surprise, it was DeFiDad. A fantastic follow and all around mensch.

So as promised, let’s zoom in…

Breaking down Ethereum Gas Fees

If you recall from Part 1, I said that public blockchains are so valuable because they are global, asset agnostic financial infrastructure and collect fees from the transfer of literally everything.

That’s never existed before! For the last 100 years we’ve had different infrastructure for currency, different infrastructure for equities, and different infrastructure for commodities. Country by country it’s unique too. And let’s not forget about all the other assets that are bought and sold that don’t have ANY financial infrastructure to support them - collectibles, art, residential real estate, cars, intellectual property.

Ethereum’s sales pitch to every asset class around the world is “hey, as long you’re in a standard token format (ex: ERC20, ERC721, ERC1155), I can support you”.

In addition to being asset agnostic, public blockchains are transaction agnostic. Here was the partial list of transactions I included in Part 1 for which Ethereum collects a fee:

Transferring Ethereum from one wallet to another

Deploying a smart contract (creating a new asset or protocol)

Swapping one asset for another

Contributing liquidity to a lending or AMM pool

Opening/closing a collateralized loan

Claiming staking rewards

Issuing an airdrop

Armed with data from Ultrasound.money, let’s dive into a breakdown of Ethereum fees by transaction type.

A little context before we get started…the time period we are looking at is the last 4.5 months since August 4, 2021 because that is when Ethereum adjusted how it calculates transaction fees. Since the network upgrade, ETH transaction fees are divided into two buckets - fees paid to miners (for processing transactions), and fees that are burned (destroyed). Unlike Bitcoin, Ethereum doesn’t have a hard cap on total supply, so a percentage of transaction fees are now destroyed to counteract the issuance of new ETH each block.

Remember, burned fees represent roughly 50% of total fees, so you can double the number in the diagram below to determine the total fees each application is responsible for. The numbers are in millions.

What Jumps Out

You immediately see OpenSea at the top of the list, responsible for almost $474M in ETH burned over the last 134 days. This is indicative of NFT’s surge in popularity, but more importantly, it highlights my point that Ethereum is asset agnostic infrastructure. Ethereum is earning more transaction fees from NFT trading on Opensea than it is from ETH transfers. This wasn’t the case a year ago.

Collectibles…check.

Uniswap is referenced twice on this list - for V2 and V3 - but I’ll come back to that when I talk about DeFi below.

Axie Infinity, the popular play-to-earn game, is responsible for $58M in fees burned during the same period. These fees represent Axie users moving assets between Ethereum and Axie’s Ronin blockchain. I should also mention that Axie generated $1.2B in revenue over the last year, fourth only to Filecoin, Uniswap and Ethereum.

Gaming…check.

Now the line item I’m most excited about is at the very bottom…”new contracts”. This is a catch-all for any time someone deploys a new smart contract on Ethereum. Those contracts could be anything - a new cryptocurrency, a new NFT, a new DeFi protocol, a new oracle, a new registry contact…the list is literally infinitely long.

Deploying a new smart contract on the blockchain is the last step in the development process, and it requires a transaction fee. Over a 4.5 month period, new smart contract deployments are responsible for burning $45M ($90M total) in ETH transaction fees.

Asset/protocol/application creation…check.

One application not pictured here because it was further down the list was Ethereum Name Service. ENS is Ethereum’s domain name registry - aka “Ethereum GoDaddy”. Similar to a domain name for your website, ENS allows you to buy “myname.eth” to identify your wallet instead of 0xabc123def456ghi789. Every time someone buys/renews an ENS name, Ethereum collects a transaction fee.

Domain names…check.

Between NFTs on Opensea, Axie Infinity, new smart contracts and Ethereum Name Services - over $659M in ETH transaction fees have been burned over the last 4.5 months, and that doesn’t take into account the percentage of fees paid to miners. That’s $3.5B total fees on an annual basis, and we haven’t even got to DeFi yet!

The Bread and Butter…Finance

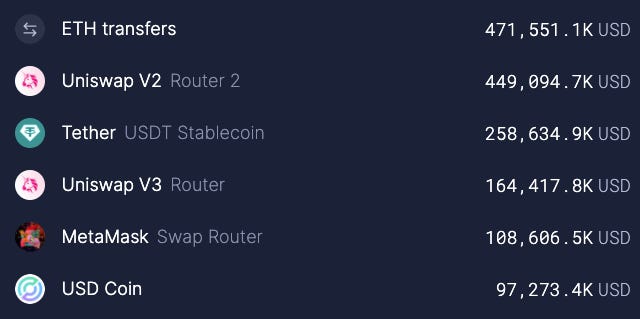

Everyone knows the “bread and butter” of blockchains is finance, so let’s look at cryptocurrency and DeFi transaction types. Here’s a shorter list of the Top 2-7 fee generating transaction types.

In the second spot are simple ETH transfers between wallets. It could be individuals or companies moving assets from one wallet to another, purchasing something with ETH, depositing and withdrawing from centralized exchanges and custodians, or those intermediaries shuffling funds internally.

In the third and fifth spots are Uniswap V2 and V3 respectively. It should be no surprise that the decentralized exchange with $1.2T in annual trading volume and over $2B in annual revenue is actually - if you combine both V2 and V3 fees - #1 by a large margin ($140M). Uniswap alone is responsible for generating over $3B in annual ETH transaction fees. And that is separate from the $2B in fees the Uniswap protocol itself collects on behalf of it’s liquidity providers.

Metamask, the ubiquitous Ethereum browser wallet, recently added token swap functionality and is responsible for over $100M in burned ETH fees in the last 4.5 months.

Rounding out the Top 7 are the two largest stablecoins by market cap - Tether and USDC - both pegged to the US Dollar. On an annual basis, Ethereum is burning over $1B in fees from stablecoin transactions.

Parting Thoughts

I learned a lot researching for this issue, but my two takeaways were this:

First, Ethereum may end up generating a majority of its revenue from non-financial services transactions. This is the beautiful irony about asset agnostic infrastructure. From a business model perspective, Ethereum’s goal should be to remain as generic and flexible as possible, because you never know what the next killer app on the blockchain will be.

Second, Uniswap is a beast. My early prediction is that Uniswap will be end up being the second most valuable protocol by revenue, behind only Ethereum or whatever the leading public blockchain is. I won’t be surprised when Uniswap is doing $100T in annual trading volume and $100B in annual revenue, and you shouldn’t be either.

Thanks for reading.

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.