Issue #46: Owning the Infrastructure - Part 1

I had a conversation with a friend who was recently promoted to a senior innovation position at one of the largest payment processors in the world. Blockchain and crypto is at the top item of his agenda, and he said he wanted to propose a strategy that was aggressive and bold.

I asked what the company’s goals were and he said one of them was to own the infrastructure.

I thought about it for a second and said “well, there are two ways you can achieve that goal. Start buying material token positions in the largest DeFi protocols, or start buying blocks of ETH and running your own Ethereum validators. Better yet, do both.”

Our conversation highlighted something that doesn’t get enough attention. Yes, we are in the middle of a technology transformation - from bank-owned financial rails to public, Internet-native financial rails. But that technology transformation also comes with an ownership transformation, and the fact that blockchains and DeFi protocols are public infrastructure means ownership is up for grabs.

Fidelity has come the closest, running a small Bitcoin and Ethereum mining operation for fun, but I am a bit surprised we haven’t seen a traditional financial institution do one or both of my suggestions. Maybe I shouldn’t be. There’s a steep technical learning curve. The regulatory environment around DeFi is unsettled, and the protocol winners haven’t officially been crowned. FI’s are cautious, and I can’t blame them.

But, the writing is on the wall. If you want to own a piece of global financial infrastructure, this is how you do it, and you better start doing it now.

Let’s zoom in…

“Owning” Infrastructure

I should clarify what I mean by ownership. Public blockchains and DeFi protocols are open source and permissionless, so technically no one owns the code. When I say ownership what I really mean is control, because while this infrastructure can’t be owned per se, it certainly is controlled.

Who controls public blockchains? Whoever is processing transactions. There are a lot of people at the crypto party, but only a handful are getting paid to be there.

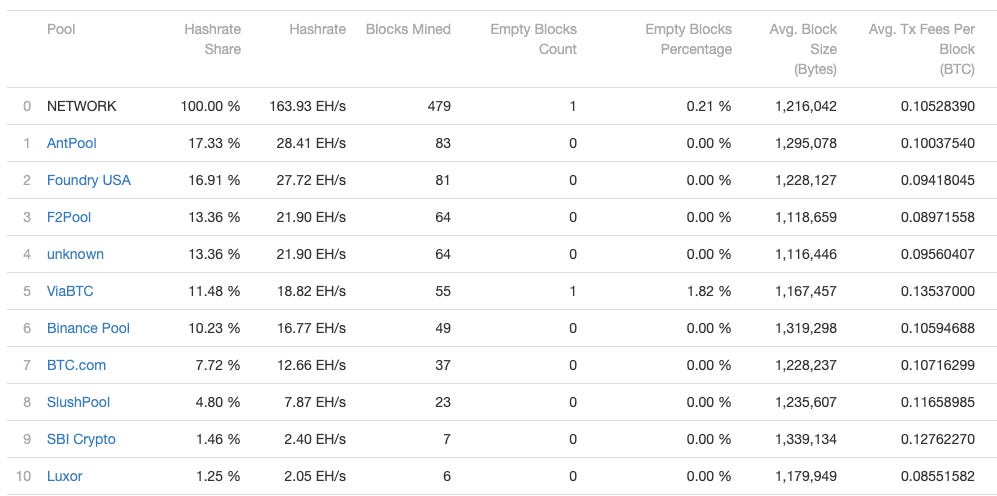

For Bitcoin, it’s the miners. Heres’ a list of the Top 10 Bitcoin mining pools by hashrate and blocks mined in the last three days.

Now the majority of transaction activity isn’t happening on the Bitcoin blockchain. It’s happening on Ethereum and other smart contract-based Layer 1s. Here are the Top 10 Ethereum miners ranked by blocks mined.

Comparing both lists above, you’ll see some similarities - F2Pool, AntPool. Mining for proof of work blockchains has very specific hardware requirements, and once you’ve got the infrastructure for one chain, it’s easier to support a second and third.

For newer Layer 1 blockchains like Solana and Avalanche, proof of work miners are replaced by proof of stake validators. Here are the Top 10 Solana validators ranked by stake:

Across all three lists, these companies are responsible for processing transactions and maintaining the integrity of the respective blockchains. And they don’t do it for free.

Fees, Fees, Fees

The ironic thing is, banks tried to “own the infrastructure” before. For roughly five years from 2015-2020, financial institutions invested in private blockchain solutions for everything from cross-border remittances to trade finance. These were useful experiments, but the most valuable thing that came out of those five years was the realization that public blockchains will win. So, while the banks premise was correct - owning infrastructure does have value - their execution was wrong.

What’s the value in owning/controlling financial infrastructure? Fees. Transacting on-chain requires a fee, and fees are collected by those processing transactions.

How much are miners and validators collecting in fees? Let’s start with Ethereum.

In the last 12 months, Ethereum generated $9.1 billion in transaction fees. These fees fall into two categories: Fee Revenue and Protocol revenue. Fee revenue is the share of Ethereum transaction fees that goes to the miners. Protocol revenue is the share of Ethereum transaction fees that are burned (accrued to ETH holders, sort of like a share buyback).

To put Ethereum’s $9.1 billion in perspective - Fiserv, one of the largest credit card payment processors in the world after its acquisition of First Data, had 2020 annual revenues of approximately $14 billion.

Now, here’s where this gets interesting. Ethereum fee revenue comes from transactions, but transactions aren’t one size fits all. There are different types. Remember, Ethereum is more like a giant, global computer than it is a distributed ledger. Here’s a partial list of different on-chain activities that require a transaction fee:

Deploying a smart contract

Swapping one asset for another

Contributing liquidity to a lending or AMM pool

Opening/closing a collateralized loan

Claiming staking rewards

Issuing an airdrop

(I’ve been looking for a breakdown of Ethereum transaction fees by transaction type but haven’t found anything yet. If I do, I will dedicate another issue to this topic!)

The point is that Ethereum is transaction-agnostic infrastructure that captures fee revenue from a wide variety of user activities, some of which is financial, but some of which is not (like smart contract deployments).

But it get’s even more interesting.

In 2020, almost all Ethereum network activity was cryptocurrency and DeFi related. Transaction fee revenue was generated by smart contract deployments, trading and other financial activity. In 2021 however, NFTs exploded in popularity and an increasing amount of on-chain activity is related to NFT smart contract deployments, minting, buying and selling.

Ethereum miners and ETH token holders are now receiving their share of transaction fees from the sale of virtual art, the minting of new NFT avatars, and combining parcels of virtual land into estates in Decentraland. This is fee revenue that traditional transaction processors and banks don’t touch.

So how big does the pie get?

Ethereum is generating $9B in annual revenue by supporting early adopter activity of essentially three asset classes - cryptocurrency, stablecoins and NFTs.

Each of these asset classes will grow. You can count on that.

There will also be more asset classes. Some will be digitally native (i.e. the Metaverse), others will be tokenized versions of existing assets. Regardless, when those smart contracts are deployed, and when those assets move, Ethereum is collecting a fee.

Who wouldn’t want a piece of that?

I know I wasn’t able to cover DeFi protocol ownership in this issue, but the cliff notes here is that buying the protocol’s token gives you the ability to participate in governance (i.e. control) and enjoy in protocol revenue. Core protocols like Uniswap, dYdX, Compound and Aave will be as valuable as the underlying blockchains in terms of transaction activity, so any institution interested in owning a piece of financial infrastructure should consider buying a large block of DeFi protocol tokens. I know it sounds like a financial investment, but it’s really an infrastructure investment.

Parting Thoughts

Can the largest transaction processors - FIS, JP Morgan, Fiserv and Global Payments - buy a stake in public blockchain infrastructure? They can. And I would love to see it happen because it would be powerful validation and trigger a wave of institutional activity.

I actually expect the banks that are doubling down on custody services - Fidelity and BNY Mellon - to make an infrastructure play in this space. It presents little additional risk and a lot of upside. They already hold the assets for customers. Why not stake them?

What’s more likely to happen though is the crypto-native equivalent of these institutions will hold on to majority marketshare. The companies on the Top 10 validator lists above, plus the large crypto exchanges, will be the next generation Fiservs and FISs, controlling the world’s transaction processing. And they will get a piece of EVERYTHING - cryptocurrency transfers, DeFi activity, NFT activity, Metaverse activity…everything.

That’s the game you want to be in.

Thanks for reading.

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.