Issue #12: B2B

Before I begin, a quick shoutout to @flynnjamm for helping me articulate some of the ideas in this issue.

This week is dedicated to a topic that doesn’t get a lot of attention - B2B, or business-to-business. Most of the companies and brands we interact with are B2C (business-to-consumer) because they are marketing to us, the individual consumer. In crypto, B2C companies are the exchanges, lending platforms and wallets. But just like we have needs being met by B2C companies, the B2C companies have needs being met by B2B companies.

The B2B side of any industry emerges when enough companies have a need to justify the existence of a new business to specifically address that need. As a general rule, the needs tend to be things that aren’t a core competency for the company. It makes more sense to buy it from someone else than build it yourself. There are outliers - B2B services that were developed by the company with the problem, who then turned around and sold the solution to the rest of the market. Amazon Web Services (AWS) is a great example of this.

The B2B market in crypto took about seven years to develop, and exploded over the last five as exchanges matured and more fintechs and banks entered the market. Here’s an incomplete list of B2B companies in crypto:

Blockchain analytics / transaction monitoring: Chainalysis, Elliptic, CipherTrace

Node infrastructure: Alchemy, Infura, BisonTrails

Smart contract audits: OpenZeppelin, Trail of Bits, Consensys Diligence

Custody/wallet infrastructure: BitGo, Fireblocks, Curve, Circle

Exchange services: AlphaPoint

There are enough businesses in the industry now to justify an ecosystem of B2B products and services, some of them like Chainalysis are unicorns in their own right.

What I didn’t anticipate happening so quickly was the emergence of a B2B market for DeFi.

Let’s zoom in...

An Ideal Market

One of the recurring themes in this newsletter is thinking about DeFi protocols as organizations, not just technology. Like organizations, protocols have revenue and expenses, and they have resourcing, technology and operational needs. They need B2B services the same way other organizations do.

They also have a few unique characteristics that make them an ideal market for B2B services:

Lean. Protocol teams are an order of magnitude smaller than their centralized counterparts. The largest exchanges employ 1500+ employees. Uniswap has 20. How? One reason. Different goals. Protocol teams aren’t trying to build and grow a company. They are trying to build a protocol and bootstrap a community that they can quickly hand over control to. Most of them don’t intend to ever be more mature than a seed stage startup. Their lean headcount is a reflection of their intention to decentralize governance and maintenance of the protocol.

One of the realities of operating a lean team is the need to be very selective with your time and resources. You simply can’t do everything. Protocol teams are lazer focused on building and developing a sustainable community. Nothing else is mission critical.

This creates a LOT of opportunity for B2B companies to step in and fill a gap.

Consistent set of needs. At their core, they are all the same thing...protocols. And protocols have a pretty consistent set of needs. They have similar technology infrastructure needs, similar smart contract audit needs, similar governance needs, and similar growth/user acquisition needs.

Every protocol needs pretty much the same set of supporting services, and most of them don’t have the headcount to do it in house. They must look external.

Based on these data points alone, you can almost predict what the B2B market will look like.

Treasuries. For a B2B market to flourish, the companies they are selling to must have budget to spend. It may sound counterintuitive given the size of the teams, but most of the top protocols have substantial treasuries that may be used (subject to some restrictions) for B2B services. At the moment, four protocols - Uniswap, Compound, Aave and Sushiswap - have over $1B in their treasuries, most of which is earmarked for the community, to be distributed over a period of years. How these treasury funds are managed is becoming more professional, mirroring the structures and controls we see in a normal organization.

Here’s a snapshot of the balance sheets for the top 11 DeFi treasuries (the full list can be found on Open-Orgs here):

Market Size

Team size, a consistent set of needs, and available budget are important, but B2B can’t survive without a large enough pool of potential customers. So how big is the protocol market?

According to DeFi Pulse, there are approximately 85 DeFi protocols. There are also another 10-20 projects, like Matcha and Ethereum Name Service (ENS) that aren’t listed because they don’t have the same TVL (total value locked) metrics as true protocols. For the sake of discussion, let’s call it an even 100.

Now we’re in the middle of a bull market, so let’s assume another 100 DeFi projects launch over the next 12 months (aggressive, but reasonable). DeFi is biting off every corner of financial services and turning it into a protocol, and there are a lot of corners.

Current DeFi projects (100) plus estimated future projects (100) equals a total market size of 200 potential customers. This is large enough to sustain many B2B businesses, especially if they have a recurring revenue model where they charge protocols on a monthly or annual basis.

What do Protocols need?

In the last year, the B2B market in DeFi has really started to grow as the number of protocols increased. We can organize the B2B market into two categories: Infrastructure and Experience (if you think there are other categories, let me know in the comments).

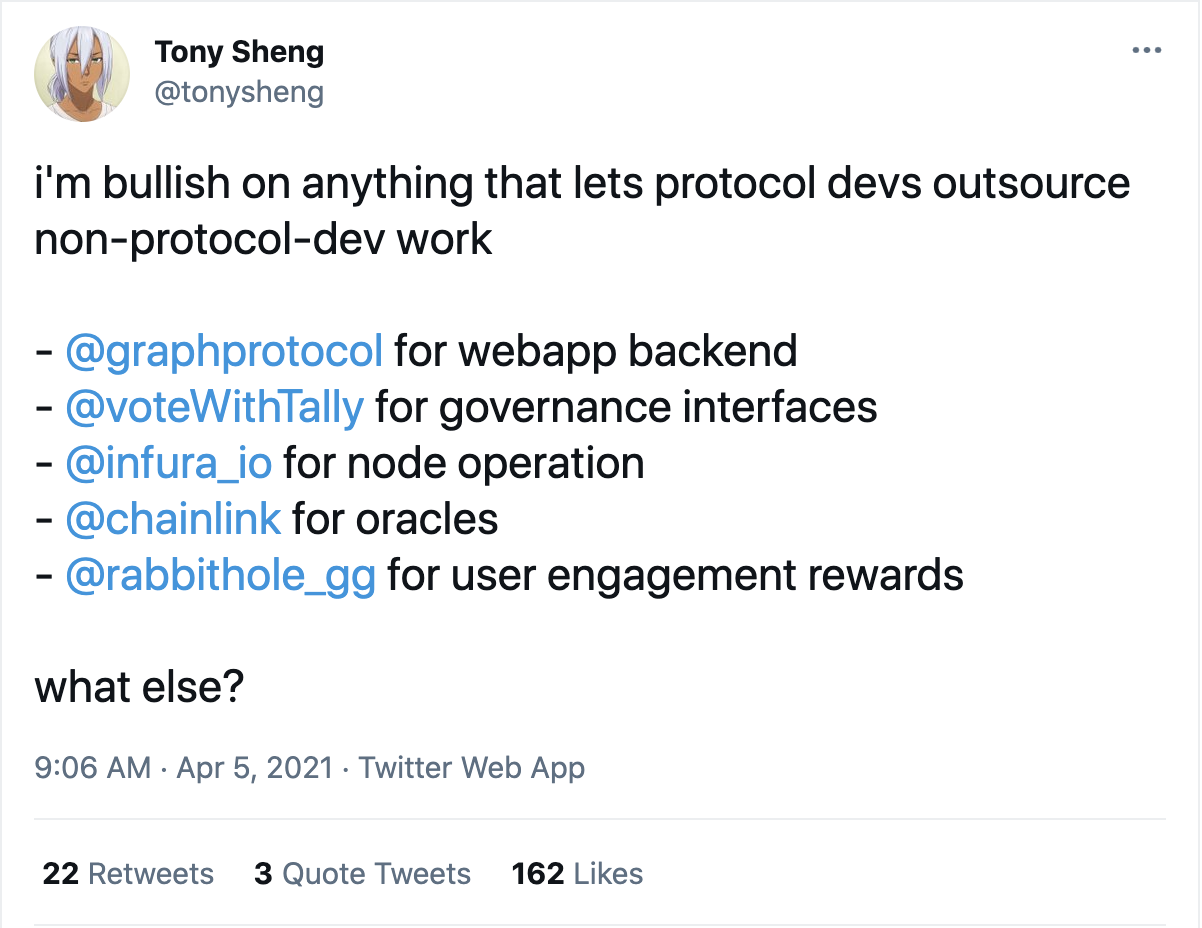

Infrastructure includes back end services; things that are abstracted away from the end user. For example, services like Infura and Alchemy that provide node infrastructure. Operating node infrastructure can be a full time job, and this is usually not a core competency of the protocol team, nor something they want to allocate headcount to.

Another example is an oracle service like Chainlink that provides pricing data to the protocol. This is critical to protocol operations.

Experience includes front end tools for different stakeholder groups. Because many of these protocols are managed by their token holders, having robust governance tools like proposal and voting dashboards is important to incentivize participation. Tally and Boardroom are great examples.

Growth/user acquisition services are emerging as well. Platforms like Rabbithole allow protocols to reach, incentivize and train new users.

You can expect more to emerge in the near future. These protocols are going to continue to grow, and they will need support.

Parting Thoughts

Every week, I come across a new data point that reinforces my belief that DeFi protocols will be some of the largest and most profitable organizations in the world. By all measures - transaction volume, revenue, balance sheets - they are rivaling the largest centralized companies in the industry today. The fact that there is a growing ecosystem of B2B services, most of which are venture backed, is another data point that keeps me bullish.

Thanks for reading,

Andy

--

Not a subscriber? Sign up below to receive a new issue every Sunday?