Issue #11: Social Trading

For the last four years, I have been part of a WhatsApp channel with a group of friends who all met working in crypto. Our channel is called Cryptonomics, and we share deal flow, congratulate each other when an ICO we invested in does well, and occasionally meet up for “portfolio rebalancing” meetings, where we throw our positions up on a white board and compare.

Cryptonomics is the modern-day investment club, leveraging a messaging app to recreate the social experience my parents enjoyed in a living room with their neighborhood investment club 25 years ago. The same activity is occurring across Twitter, Discord, Reddit, and a dozen other platforms.

Technology has changed the way we connect, communicate, and coordinate. If it wasn’t already obvious, GameStop and WallStreetBets made sure everybody knew.

I’m fascinated by the impact of social technology tools on people’s investment decisions. Do they make better decisions? Do they get better returns?

In this week’s issue, we explore social trading - the merging of social networking tools with the investment experience. Social trading is the future of investing whether we like it or not, and blockchains and DeFi make it a heck of a lot more interesting.

I’m undecided on whether it is ultimately a good thing for our humanity. Most things involving social media aren’t.

Let’s zoom in…

Social Networks

The value proposition of social networks like Facebook, Instagram and Twitter is rooted in their ability to connect us…to people we know, but more importantly, to people we don’t know. I don’t know the majority of the people I follow on Twitter. We have a tenuous but mutually beneficial connection akin to the kind a musician has with a fan in the audience. We see each other, we hear each other, but our connection is specific to a place and time.

These networks started out as platforms to connect us, but have been re-engineered over time to look like media companies, incentivizing users to share more frequently (content creation) and stay on the platform longer (content consumption). They have a few core features that make them incredibly sticky.

Connection/Network Effect - Each new participant and connection is a value multiplier for the network. The network value grows as the number of participants and connections grow.

Reputation - Platforms like Instagram, Twitter and YouTube have gamified the social experience by incorporating reputation (aka followers/subscribers). This reputation is a proxy for quality and legitimacy, and it translates to an audience that can be monetized.

Feedback / content sentiment - Social media platforms incorporate features and mechanisms for real time feedback on content - the “like” button and retweets. These features measure sentiment around a piece of content.

These components working together create sentiment filters. The more positive feedback a piece of content receives, the broader distribution it gets.

This dynamic has given birth to the influencer - the professional user that has built an audience by successfully navigating the sentiment filter. If I consistently create content people like, my audience will eventually grow. Influencers are the result of the three components of social media platforms - connection/network effect, reputation and feedback - working together over a long enough time horizon.

What happens if you apply these components to the investing experience?

Social Trading 1.0

Social trading platforms have combined the components of social networks with the stock and crypto trading experience. If social media is about commanding your audience’s attention, social trading is about commanding your audience’s capital and decision making.

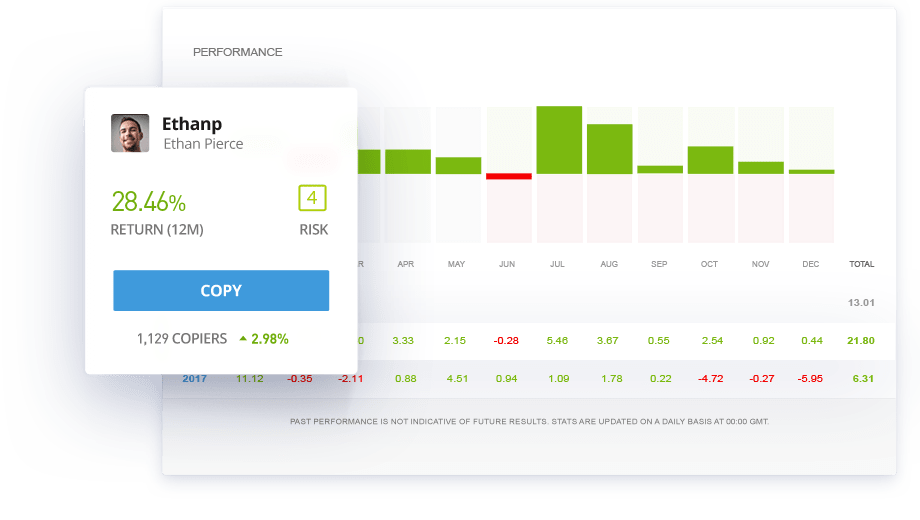

One of the best-known social trading platforms is eToro, an Israel-based brokerage founded in 2006. Similar to Robinhood, you can buy both stocks and crypto. eToro’s differentiator though is a feature called copy trading that allows users to copy the portfolio allocation of other eToro users.

Portfolios are ranked based on performance and risk in leaderboard-like fashion. Users can view the contents of a portfolio, historical performance, risk level and number of copies. Number of copies is equivalent to followers on social media platforms, and eToro incentivizes sharing by paying users when their portfolio gets copied.

Tying this back to social networks, the portfolio has become another piece of content marketed to an audience, and the creator of that portfolio holds the position of influencer. Only here, the sentiment filter is pretty simple and objective. The portfolio either performs relative to others or it doesn’t.

Social Trading 2.0

Today’s social trading experience is a reflection of today’s investment experience - the brokerage platform. However, as the infrastructure underpinning our financial system shifts to public blockchains and open protocols, the type of financial activity and the way we engage is evolving in parallel.

I’ve talked about the “be your own bank" narrative in crypto starting to sound more realistic as DeFi matures, and it is the perfect analogy for how to think about the future investment experience. How different could social trading look as a result. Very different.

For starters, DeFi has an inherently social aspect because all holdings and transactions are visible on a public ledger. I’m not limited to seeing what you hold on a particular platform, I can see your entire transaction history (note - there are definite downsides to this level of transparency).

The transparency of DeFi activity adds a new dimension to financial influencer. What’s in your wallet says a lot about who you are, and serves as a strong signal to the market about your strategy, beliefs, etc.

A great example of this happened in January, when online sleuthing discovered Mark Cuban’s Ethereum wallet address after he revealed on Twitter he had purchased a specific NFT. We also learned that Mark owns approximately $150,000 of AAVE, the governance token for the DeFi lending protocol of the same name.

DeFi is a new playing field, with new rules, and it will continue to inspire brand new investing experiences.

In researching for this issue, I came across a soon-to-be-launched social investing platform for DeFi called Prysm.

Prysm adds a social and influencer layer on top of DeFi, allowing users to view and copy trades from top traders (a la eToro), contribute to and track market sentiment around an asset, tip traders, and manage an audience (ex: subscriptions and streaming revenue). All the components of social networks today, but juiced with the transparency of public blockchains and the dynamics of DeFi.

Prysm is currently in private alpha, but you can sign up for the waitlist here. Full disclosure, I have no interest in or relationship with Prysm. I’m just a fan and excited to see what they do. Side note - I wrote about “compound innovation” a few weeks ago and Prysm is great example of compound innovation in action!

Platforms like Prysm will produce a new investment experience and a new generation of financial influencers. In the not too distant future, these influencers will compete with and direct capital at the same level as large asset managers today.

Parting Thoughts

I’m worried about the long term effects of social trading, and whether it incentives the wrong behavior. Social media incentives you to stare at your phone for hours on end, and rewires your brain to crave the stimulation you get from a never ending stream of new content and a real-time feedback loop.

Will everyone turn into a day trader? I hope not, because 90% of day traders today lose money (true story).

As I’ve written about before, the sure way to generate wealth is by saving over a long time horizon, and benefiting from compound interest. Unfortunately, this is the financial equivalent of watching grass grow, and our brains are becoming increasingly addicted to the instant gratification provided by the online social experience.

Thanks for reading,

Andy

Not a subscriber? Sign up below to receive a new issue every Sunday!