Issue #9: Compounding Innovation

For those of you following our journey across the country, we arrived in Phoenix last week. This is city #7 since September 2020, and we will be here for another month. The expectations for Phoenix weren’t high when we arrived, but I am pleased to say the city has far exceeded our expectations. Warm, sunny, palm trees…it’s a cleaner Vegas, and a cheaper Los Angeles, minus the beach.

This week I’m exploring a topic I have been thinking a lot about - compounding innovation. I briefly discussed this at the end of my first issue, but it deserves more attention and focus.

I also saw a great slide recently from @pbrody that communicated visually (and very effectively), what I have previously tried to describe in writing. So like any mediocre writer that used to practice law, I’m going to shamelessly steal the ideas of better writers and bury their credit in the footnotes 😉.

Let’s zoom in…

The Power of Compounding

At the recommendation of a friend (@flynnjamm), I recently read The Psychology of Money by Morgan Housel. The book offers some foundational principles about saving, investing, and ultimately building wealth, and helps you understand when human psychology and emotions impact judgement. If 90% of life is just showing up, 90% of investing is just managing your emotions.

Along with Rich Dad, Poor Dad by Robert Kiyosaki, The Psychology of Money should be required reading for anyone at any age, with any amount of net worth, but especially young people.

One of the topics Housel highlights early on, and that I became obsessed with after reading, is the power of compound interest. Einstein called compound interest the 8th wonder of the world, and Buffet is quoted as saying “my wealth has come from a combination of living in America, some lucky genes, and compound interest”.

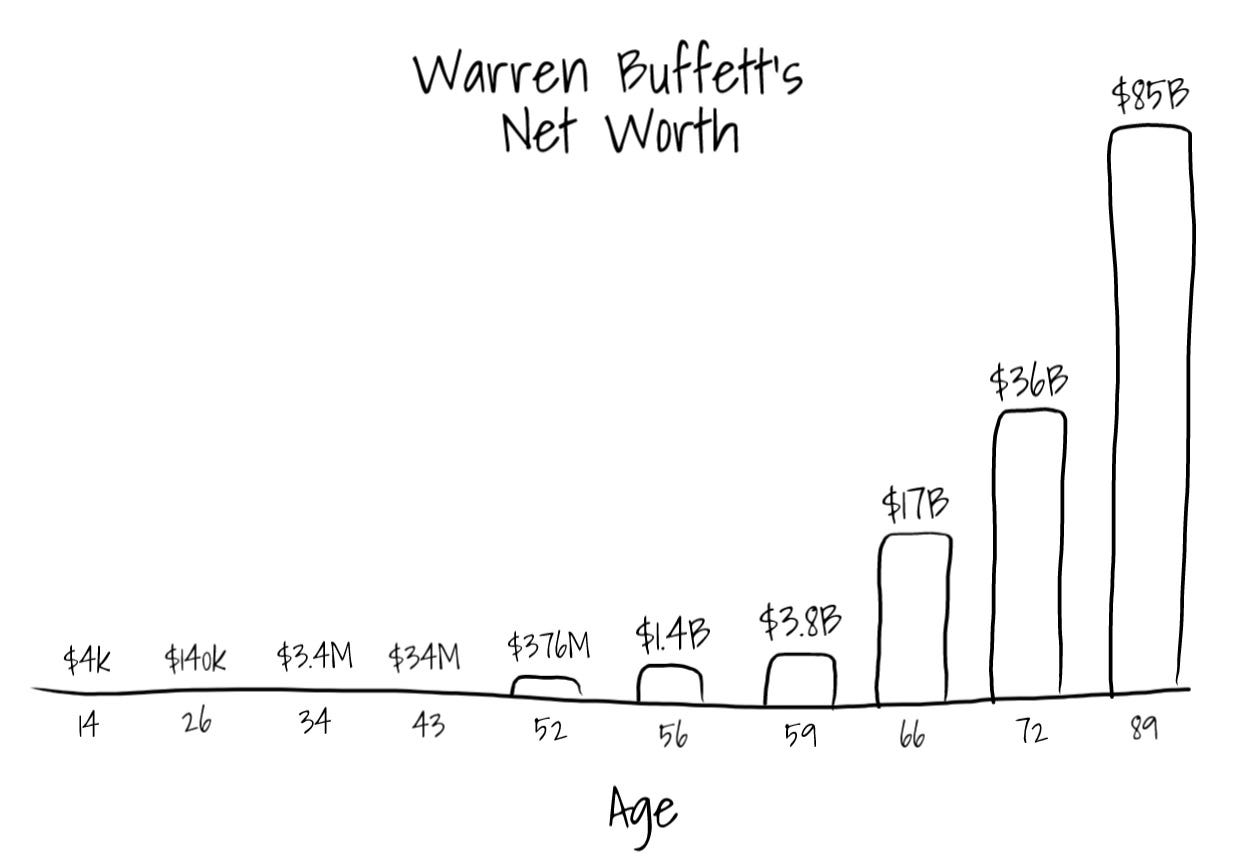

When The Psychology of Money was published in 2020, Buffett was 90 years old and had a net worth of $85 billion, give or take a few. Amazingly, close to $80B of his fortune was earned after the age of 65. At the age most people think about retiring and transitioning to “wealth preservation” mode, Buffet was pedal to the metal earning a whopping $80B.

The secret…compound interest.

$100,000 invested at an 8% return compounded over 40 years would grow to approximately $2.5M. Not bad. But extend the timeline over 75 years, which is how long Buffett has been investing, and your $100,000 would be worth almost $40M. For a 1.8x difference in time, you get a 16x difference in your return. That’s the power of compound interest.

Buffett isn’t the best investor measured by average annual returns, he has just been at it the longest. Time is the greatest multiplier of wealth.

Compounding Innovation

Time is the greatest multiplier of technology innovation as well.

Compounding innovation is the idea that over a long enough time horizon technologies will converge to enable net new innovation. Technology A, combined with Technology B, creates something novel that couldn’t have existed in the absence of either A or B.

One of the best examples of compound innovation is the combination of GPS technology and smartphones to enable ridesharing services like Uber.

GPS, or Global Positioning System, was a project launched by the US Department of Defense in 1973 that became fully operational in 1995. Apple launched the first iPhone in 2007. On the shoulders of both technologies, Uber was founded two years later in 2009.

As @pbrody said to me when discussing this concept – it’s fairly easy for someone to predict adjacent innovation - innovation one step forward from your current technology - but it’s really hard to predict innovation 3 or 4 steps out. Ridesharing was impossible to predict in 1973 when all you had was GPS technology, but it became a little more predictable in 2009 when GPS enabled smartphones were commonplace.

40 years in the making

Just like a new musician or comedian can sometimes seem like an overnight success when in reality they have been grinding it out in clubs for years, slowly building momentum, new technology can feel like it comes out of nowhere. One day…BAM! Blockchains are another great example of a technology that looked brand new, but was actually an amalgamation of decades of compounding innovation.

· Hash functions were first used by IBM in the 1950s

· The Internet was funded by DARPA in the 1960s

· Public key cryptography was invented 10 years later in the 1970s

· Proof of work consensus was conceived of in 1993

Four of the core technology components blockchains rely on were developed over a 40 year period from 1953 to 1993 (!), but didn’t elegantly come together until 2009.

In hindsight, this collision of technologies seems inevitable, but it would have been really hard to predict blockchain technology in the 1970s with only Internet, hash functions and public key cryptography.

Accelerated Timeline

Compounding innovation is happening on an accelerated timeline on top of blockchains, fueled by token standards and open source smart contracts.

Token standards like ERC20 (fungible) and ERC721 (non-fungible) eliminate the technical barrier to creating a new digital asset, and have led to an explosion in the number of cryptocurrencies and NFTs.

Open source smart contracts (ex: DeFi protocols) are effectively serving as a public set of accelerators and building blocks for engineers to build whatever they want with.

The box of money legos is getting REALLY big, and things are compounding REALLY fast.

This industry is Buffett at age 65, and we are pedal to the metal.

Parting Thoughts

The themes for the next 2-3 years appear to be taking shape - DeFi, NFTs and DAOs. This is the adjacent innovation that is fairly easy to predict.

The harder, but more provoking thing to explore is how innovation will compound three or four steps out.

Thanks for reading,

Andy

Not a subscriber? Sign up below to receive a new issue every Sunday!