Issue #65: Wealth Distribution

Every Thursday, the Forta Foundation team gets together on Zoom for a virtual Happy Hour. I still haven’t met a few of my colleagues in person yet, so this is the only time I get to learn about who they are outside the office. Everyone has a story to tell, you just have to ask.

The rule is “we don’t talk about work”. More often than not, someone poses an interesting question that ends up snowballing into a discussion about economics, politics, the impacts of social media, etc.

This week, the question from Juan was “will crypto and Web 3 have a positive impact on wealth distribution and equality around the world?”

During the discussion, I was pessimistic. The growth of the tech industry over the last 30 years has objectively had the opposite effect. Value creation was concentrated amongst a smaller group of companies (many of whom operate effective monopolies in their respective verticals), and the wealth created is concentrated amongst a smaller group of people (founders, early employees and investors). Seven of the nine richest people in the world founded or ran US-based tech companies and have a combined wealth of roughly $1 trillion.

We’ll get into what enables the tech industry to create and capture a disproportional amount of value, but the question I really want to dive into is “will crypto and Web 3 perpetuate the wealth gap, or could it level the playing field?”

Let’s zoom in…

Web 2 Value Capture

As I alluded to above, over the last 30 years the largest tech companies have been able to create and capture a disproportional amount of value relative to their size.

Amazon, Microsoft, Google, Apple and Facebook are effective monopolies in e-commerce, operating systems, search, smart phones and social media - owning entire sectors and capturing a majority of their sectors’ value.

Their founders and CEOs - Bezos, Gates, Page, Brin, Ellison, Ballmer, Zuckerberg - have accrued massive fortunes as well. I get to throw Elon in this group now that he owns Twitter :)

This boils down to the fact that because of computers, software and the Internet, a small team can create and capture value at unprecedented multiples. Sudden spikes in value creation have happened before in history too….during the Industrial Revolution, when machines replaced human labor.

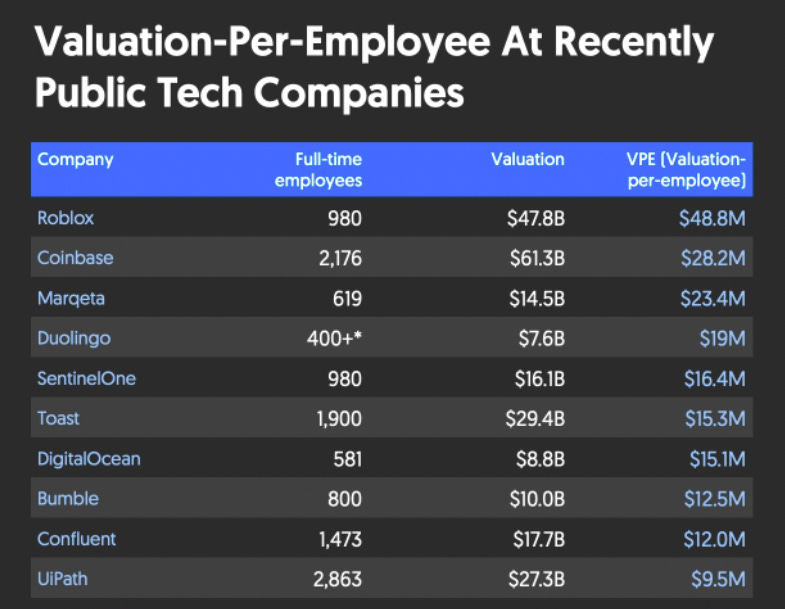

When Amazon went public in 1997, it had 256 employees. The market cap of Amazon at IPO was $438M, translating to a valuation-per-employee of $1.71M. Today, the valutions-per-employee at recently public tech companies are even higher…

Another angle to the wealth concentration conversation is geography.

The seven companies founded or ran by the eight wealthiest tech billionaires above are based on the US’s West Coast, in California and Washington.

Early employees with the largest ownership stakes would have also been based in close proximity to the main office, leading to a concentration of personal wealth in those areas. It’s no surprise that 3 of the Top 7 highest growth real estate markets in the US since 2000 are San Jose, San Francisco and Seattle.

Financialization

Even outside of tech, asset ownership has concentrated over the last 30 years.

Since 1980, the US economy has experienced rapid financialization, where a growing percentage of corporate profits have resulted from financial activities rather than trade or production. Over that same time period, there’s been a shift in US household wealth from real assets (real estate, commodities) to financial assets (stocks, mutual funds). From 1984 to 2011, real estate fell from 40% of a households’ wealth to 25%, whereas financial assets grew from 25% of a households’ wealth to 50%.

The top 10% of US households own 90% of stock and mutual fund wealth, but only 30% of principal residence ownership wealth. There’s a barrier to ownership of a physical asset that doesn’t exist with a financial asset…you need to be in close proximity to the physical asset to get the utility. This is why people who live in Detroit own houses in Detroit, and people who live in San Diego own houses in San Diego, not Detroit.

My conclusions here are:

(a) technology and the Internet enable us to create more value with less people, and the traditional company structures allowed those people to capture a disproportional amount of the value, and

(b) financial asset ownership is more susceptible to concentration than physical asset ownership because physical location doesn’t eliminate the financial asset’s utility.

Web 3 Wealth Distribution

Web 2 crypto wealth has a similar distribution as the broader tech industry.

Crypto started in a Web 2 world, dominated by centralized companies headquartered in the usual hubs like San Francisco. The bulk of the value creation and capture happened at a few large exchanges (Coinbase, Binance, FTX). Their small teams created a disproportional amount of value, and their founders and early investors have captured a majority of the wealth creation. The CEO’s of these three companies (only one of which is publicly traded) all appear on the Forbes 100 list.

On the asset ownership side though, interestingly, while approximately 70% of BTC is owned by the Top 2% of network entities, there has actually been gradual and consistent growth of retail investors from 2012 to 2022. In 2012, retail investors owning 10 BTC or less held 2% of the total supply. In 2022, that same segment of retail investors own roughly 12% of the BTC supply.

I love this stat because it bucks the norm. Generally, high risk/high growth asset classes (i.e. tech startups) are not easily accessible by the average retail investor. The unique thing about crypto is that it is both high risk/high growth and easily accessible.

Seeing retail own 10%+ of an asset you could argue is still finding product-market fit is refreshing, and a powerful indicator of a potential shift in wealth distribution.

Geography

Geographically, Web 3 is far more diverse than Web 2.

There’s no doubt San Francisco and New York are hubs of activity, but they aren’t as dominant as Silicon Valley and Seattle were 20 years ago.

The default working arrangement today is “remote-first”. You can be anywhere, which means startup teams are more geographically diverse. For the first time in my life, a majority of my colleagues are based outside the US (this happens to be one of my favorite aspects of working in this industry too).

The best people live everywhere.

Two other market forces that are influencing where crypto and Web 3 talent and companies are based - regulation and taxes.

There’s been an exodus of crypto talent to states like Nevada, Texas and Florida with no state income tax, and to countries like Puerto Rico and Portugal with favorable capital gains treatment.

For companies, regulation and taxes can impact where you base operations. FTX, now one of the world’s leading exchanges, recently moved its global headquarters from Hong Kong to The Bahamas primarily for regulatory and tax reasons. A move like this wasn’t realistic for the previous generation of tech companies. They needed to be where the talent was.

Value capture

Web 3 value capture is already far more distributed than Web 2.

It starts with ownership. Distributed networks and applications aren’t owned the same way their Web 2 counterparts were. For example, it has become customary for protocols launching a token to allocate 50% or more of the total supply to the community via airdrops, grants, rewards, etc. That means 50% less held by founders, early team members and investors, and 50% more held by users and early supporters.

Value capture is naturally more decentralized too. Blockchains and Web 3 protocols generate a lot of revenue, but it’s not captured by a single company. Instead, fee revenue is distributed to miners, validators, stakers and liquidity providers.

Now you can argue these stakeholder groups are simply replacing the employees in a traditional company structure. And while there is some logic in that, the fact that there isn’t a single entity with concentrated ownership sitting in the middle means the value capture in distributed systems is more…distributed.

Parting Thoughts

As I was writing this issue, I had the ownership economy in the back of my mind. The number of assets being created is growing exponentially. Access to these newly created assets is increasing every day.

How will the ownership economy, especially NFTs, impact wealth distribution? One thing I’m confident of is that it becomes more geographically diverse. One thing I’m not sure about is how concentrated it will be.

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.