An airdrop, a whale, a perturbed community and a governance vote.

Every once in a while, you come across a story so good it writes itself.

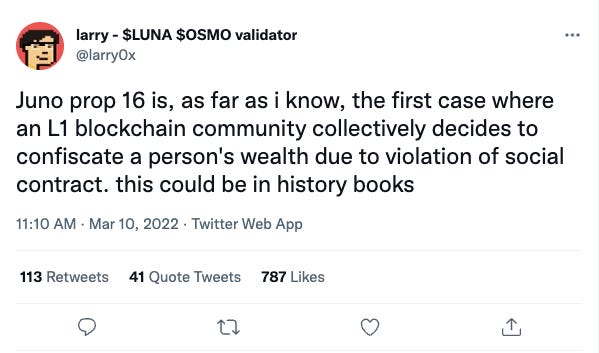

If you weren’t paying attention to a tiny corner of the Cosmos ecosystem last week, you may have missed one of the most controversial governance votes the crypto industry has ever seen.

It’s story time…

The Airdrop

Juno is a new-ish smart contract blockchain in the Cosmos/IBC ecosystem. It launched last October and, as has become customary in the Cosmos ecosystem, at launch the core team airdropped the chain’s native token - JUNO - to wallets staking ATOM (known as a “stakedrop”).

To qualify, you must have been staking ATOM at the snapshot date - February 18, 2021.

The stakedrop was a generous 1:1, so if you were staking 10,000 ATOMS, you got 10,000 JUNO. Of particular relevance to this story is the fact that the airdrop had a “whale cap" limiting the amount of JUNO per wallet to 50,000. If you were staking 100,000 ATOMS, you only received 50,000 JUNO.

This measure was put in place to ensure a healthy distribution of JUNO and a single wallet didn’t receive an outsized percentage of the token supply.

The Whale

Shortly after launch, the JUNO community noticed the consolidation of 2.5M JUNO into a single address. After further analysis, it turned out that 52 wallets in total - most of them receiving the maximum 50,000 JUNO - were controlled by a single entity.

There was speculation that this “whale” must have had insider information. It’s too suspicious that the ATOMS were spread across over 50 wallets, each with a balance of or close to the whale cap.

The Juno community was immediately and justifiably concerned about the damage the whale could cause the network if it decided to go rouge. If it sold, it would wipe out all JUNO liquidity across decentralized exchanges. The whale was also delegating all 2.5M JUNO to a single validator, centralizing the network. They also have a meaningful influence over governance and *could* buy support from validators.

It’s also not easy to dilute the Whale’s position over time. Assuming the full amount is staked, they earn roughly 10% of the token supply’s inflation.

See the Whale’s address here.

Proposal 4

October 7, 2021

The community acted quickly, submitting Juno governance Proposal 4. The Proposal, if approved, would have taken 90% of the Whale’s JUNO.

When Proposal 4 was posted, the Whale reached out to the JUNO team explaining that they operated a fund, held ATOMs (and now JUNO) for many clients, and distributed their assets across different wallets for security purposes. They assured the JUNO team that they had no interest in putting the network at risk, and had already started redelegating their tokens across over two dozen validators to quell centralization concerns.

While still suspicious, the Juno community was more comfortable the Whale would act in the best interest of the network.

The community voted against Proposal 4.

56.4% No

7.1% Yes

36% Abstain

The Whale keeps their JUNO.

Proposal 16

March 10, 2022

Since October, the Whale appeared to be honoring their commitment to the community. Their JUNO was staked across 31 different validators, earning roughly 100% APY. They were restaking daily rewards, and by March had amassed 3.1M JUNO. When the price of JUNO peaked on March 2 at $45.56, the Whale’s position was worth over $140,000,000, and was generating almost $400,000 in daily staking rewards.

In March, the Whale’s behavior changed. The community observed that instead of restaking rewards, the Whale was selling daily, exerting constant sell pressure on the market. Suddenly, the community’s concerns that were dispelled in October were back. Does the Whale really have the network’s best interest at heart?

After tense discussions with the community, the Juno core team takes action and submits a new proposal for a governance vote.

This new proposal - Proposal 16 - would reduce the Whale’s stake from 3.1M JUNO to the original whale cap of 50,000. The appropriated tokens would be placed in the Juno community pool for future use.

If I lost you talking about 100% APYs and staking rewards, all you need to know at this point is the Juno community is voting for a second time to seize 98.4% of the Whale’s assets for (a) violating the spirit of the airdrop, and (b) spooking the community with their trading activity.

…

Before we go any further, let’s clear up a few things…

First, why doesn’t the whale immediately sell his JUNO? Well, all 3.1M are staked and there is a 28-day unlock period. The Whale must wait four weeks before they can sell.

Second, can’t the Whale vote against Proposal 16 and influence the outcome? Yes, but he only controls 7% of the voting power. Enough to impact, but not enough to guarantee the Proposal fails.

Third, how does a community seize tokens without the owner’s consent? A hard fork. You need to edit the blockchain and convince all the validators to adopt the new version. If you’re looking for a historical example, go read about Ethereum’s The DAO :)

…

Voting for Proposal 16 was open between March 10 and March 15.

Just like Proposal 4, the new proposal was controversial and divided the community.

There were good arguments on both sides. Some said the blame should fall on the core team for a sloppy airdrop. Others contended the Whale gamed the system, and while they may not have broken any law, they violated the spirit of the airdrop and put the network at risk.

On March 15, Proposal 16 was approved.

40.9% Yes

33.8% No

25.4% Abstain or Other

This was the easy part.

The Hard (Fork) Part

Hard forks aren’t easy. You are amending the blockchain and creating a new source of truth. They require an enormous amount of coordination. The larger the community, the harder it is to get everyone on the same page.

The other element here is time. There’s a shot clock.

The community has to code and execute the network upgrade before the Whale’s tokens are unlocked. If they attempt to sell their entire position on the open market, it would wipe out all liquidity on DEXs. Daily trading volume globally fluxuates between $5-10M.

If you assume the Whale unstaked their full position on March 10 when the proposal was posted, they would get access to their tokens on April 7.

We’ll see how the next feelw weeks play out.

Another draft proposal involving a so looftware upgrade (but presumably not a hard fork of the network), is available here.

Takeaways

I can’t help but draw parallel’s between the Juno community’s reaction to the Whale and the world’s reaction to Russia’s invasion of Ukraine. Note - I’m not comparing the Whale and Putin.

Over a dozen countries have imposed sanctions on Russia and it’s elite, including freezing and/or seizing billions worth of assets around the world.

I don’t know what laws Putin has broke (I’m assuming many), I’m not an expert in international law or the myriad of conventions and treaties governing country borders and relations. What I do know is he broke a social contract with the rest of the world. You don’t invade a sovereign nation without provocation.

If you break the social contract, there are consequences.

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.

is the lesson learned such that communities would require some sort of KYC to pro-actively avoid Whales in their ecosystem?