Issue #6: Scaling DeFi

From 30,000 Feet…

I’ve written a lot about DeFi recently, but it has been either retrospective (what’s happened) or current state (what’s happening). This week, I want to look ahead, and discuss what I see around the corner and why.

Over the last year, the total value locked in DeFi has grown from $1B to $40B. By any measure, that is phenomenal growth, and we are only in the second inning.

But this game is not about billions, it’s about trillions. DeFi is global infrastructure that must scale to support tens of trillions of dollars of financial activity. Today’s issue is about what it will take to get there.

Let’s zoom in…

Gateways

For the last three years, DeFi has been a small, but fun, island in the middle of nowhere. There are no direct flights. In most cases, getting there requires connecting through a centralized exchange (Coinbase, Gemini, Kraken, Binance) to exchange dollars for crypto. After you’ve purchased crypto, you must transfer it to a self-hosted wallet to interact with DeFi applications.

This two-step process is inefficient and keeps a lot of would-be users out. Fortunately, it’s only temporary.

Soon, large platforms (e.g. exchanges) will be the primary gateways into DeFi, providing fiat onramps and a direct connections to a variety of protocols, all under one roof. This opens up DeFi to the masses.

Platforms may give users the ability to directly contribute to a Uniswap liquidity pool, for example. Or, they may wrap their own passive investment product around the protocol (ex: high yield savings account, where the underlying yield is generated by a DeFi protocol), abstracting the technology away completely.

There are two forces pushing the market this direction.

Customer experience – The DeFi customer experience is not great and requires a high crypto IQ. Today, users connect self-hosted wallets like Metamask to a bare bones dashboard and initiate transactions directly with the protocol. This is the definition of DIY. No advice, no customer support, no insurance, no reversibility. You are on your own.

Centralized platforms fix this, and provide an experience that appeals to a broader set of users.

Regulation – I’m not the “regulation guy”, but I’m also realistic, and the reality is there is just too much money moving through DeFi without KYC or transaction monitoring. Regulation will come, and when it does, activity will get pushed to regulated platforms.

I don’t view this as a bad thing either. User still have access to DeFi products and services, they will just access them through a regulated platform, with a better experience and the protections and support they expect. Regulated platforms will also be great quality filters, which I touch on more later.

Capital Monsters

When it comes to the financial market as a whole, the golden rule is the more liquidity the better. The more capital there is, the more efficient the market.

DeFi protocols are themselves small financial markets, and they need liquidity to survive. They are capital monsters, and will eat as much as you can give them (with no real limit).

There is approximately $40B in DeFi today, most of which is allocated across the ten largest protocols. This represents tremendous growth year over year, but the capital monsters need more. Price slippage on trades still exists, and rates on loans are still high. The market can be more efficient.

For DeFi to scale into the trillions, it needs more liquidity, and that won’t happen by attracting one retail user at a time. DeFi has to tap into large liquidity pools.

Who has the most liquidity? Companies with giant user and/or asset bases.

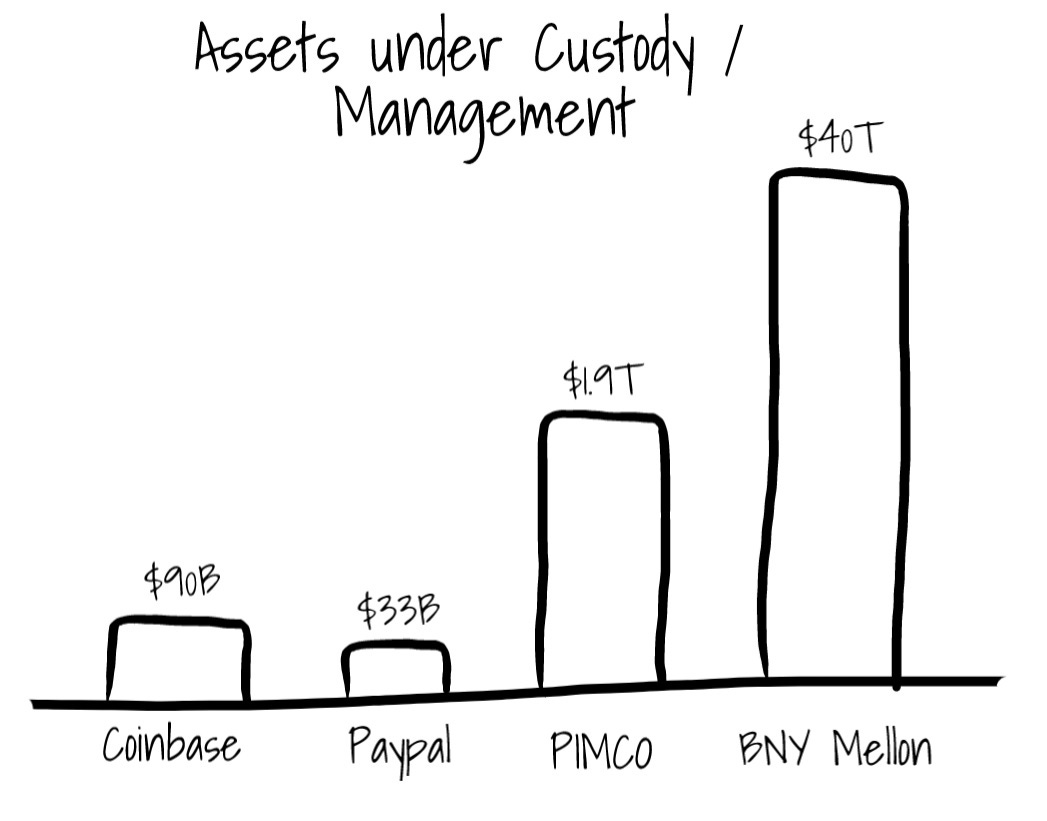

Coinbase announced recently it has over $90B of assets in custody. Paypal holds $33B for its customers. And BNY Mellon, the world’s largest custodian who recently announced a move into digital asset custody, holds over $40T (yes, trillion) of client assets, equal to a 1/10th of the world’s wealth.

This is the capital DeFi needs to scale. If you don’t believe me, talk to the BD leads at large protocols. They know that growth requires reaching outside the crypto-native ecosystem to more traditional players.

How might this play out?

They won’t all rush in at once, and the order will mirror that of crypto adoption. Not coincidentally, this ordering reflects likely market share as well.

Crypto native platforms (exchanges, custodians). DeFi is in their backyard, and this group will be the first to integrate with DeFi protocols.

Fintechs will be second, lead by companies like Square and Paypal. If not, they risk losing market share to crypto-native companies.

Banks naturally move slower, but will eventually adopt DeFi out of necessity.

Quality Filter

Another eventuality, and benefit, of having regulated entities serving as gateways into DeFi is the quality filter it creates.

There are a growing number of protocols, but not all are created or tested equally. Right now, the onus is on the individual user to do his/her own due diligence. Even if they do, they are still assuming an unacceptable amount of risk. Like a lot of things about DeFi, this just doesn’t scale.

The most scalable way to perform due diligence on protocols is to centralize it and put a formal process in place to ensure consistency.

Exchanges and custodians already do this for tokens today. Particularly in the US, exchanges have robust token listing frameworks that asses and test every aspect of a new token being considered for listing. An exchange may look at the size and activity of the token’s community, the technology and the value proposition of the token, as well the legal classification (e.g. a security or not).

Regulated gateways have to, and want to, perform the same level of diligence over DeFi protocols. Areas that could be assessed during the due diligence process include:

Founding team

Controlling parties (large token holders)

Protocol governance process

Treasury management program

Smart contract testing

Economic stress testing

Legal/regulatory matters

Vibrancy of community

Fee and incentive structure

General financial and operational risks

This is the stage of the game where quality and security matter. Not every protocol will make it through, and that’s ok. For DeFi to scale to the trillions, we need to find the best protocol for X financial arrangement, and make it a global standard.

Parting Thoughts

If the last decade was about legitimizing and scaling cryptocurrency, the next decade is about legitimizing and scaling DeFi, and I have never been more excited and motivated to work towards something.

Thanks for reading,

Andy

Not a subscriber? Sign up below to receive a new issue every Sunday!

This actually answers my question from Issue #4.