Another issue inspired by a conversation with a friend…it’s where most of my ideas come from these days, and a reminder that talking with people in different corners of the industry is one of the best ways to expose yourself to new things.

If you’ve been reading 30,000 Feet for a while, you might recall the Metaverse issue last Summer where I talked about renting my virtual land in Decentraland to a friend who put a virtual battle arena on it. It was an experiment to (a) do something fun with a lifelong friend, (b) learn how to delegate my land to someone else, and (c) see if we could actually monetize these assets that had been sitting idle in our wallets for, in my case, several years.

A and B happened immediately (justifying the experiment), and I recently learned that we received our first royalty on the property. Someone bought an Ethermon in his arena, and collectively we earned a $600 commission in MANA from the sale ($300 each). My virtual land and his commercial property are income-generating assets now. Pretty cool.

In the same conversation, he mentioned he is lending out his NFTs for a play-to-earn game and earning more per day than he does from his day job. That made me pause. He is monetizing his NFTs - yield from play-to-earn lending, and commission from sales on his property - and there is enough demand for the former that he is able to earn the equivalent of a second full-time income.

My friend is not alone. He represents a new class of “owners” that control scarce virtual resources and are finding ways to monetize them.

It’s time to start thinking about digital assets, especially NFTs, as resources. And just like the physical world, you want to own/control as much as possible.

Let’s zoom in…

Resources

Resources refers to all the materials available in our environment which help us satisfy our needs and wants.

In the physical world, resources are scarce by virtue of there being a fixed supply of matter on this planet. There’s only so much land, water, minerals, oil and precious metals, and they are in high demand. They are vital to countries, economies and communities.

Short side bar…I did a deep dive on sand a few years ago (interesting use case for tokenization) and have been trying to weave it into an issue for a year. The global market for sand is fascinating and I don’t know when I’m going to get a better chance to talk about it, so here we go!

Sand is the world’s second most consumed natural resource, behind water. It doesn’t have the brand that oil does, but it’s arguably more important. Sand is the primary raw material in concrete, used to construct shopping malls, office buildings, bridges and roads. Glass is just melted down sand, used for car windshields and smart phone screens, and the silicon chips inside our phones, computers and hundreds of other electronic devices are made from sand.

…and we are running out of sand.

Desert sand covers huge parts of our planet, but it can’t be used in concrete because it’s the wrong shape. It is too round, smoothed down by wind over thousands of years. The sand used in concrete is the kind of sand found on the bottom of river beds, ocean shorelines and lakes. This sand is more angular and holds together better.

As our civilization expands, the demand for sand has increased and eclipsed supply. Countries that have a lot of it, like Australia, are selling it to countries like Singapore that need it to build infrastructure (thanks for indulging me!).

Virtual Resources

To further define “resources”, I think of them as a raw material you need to do something else. You need sand for concrete. Land to farm. Oil to operate a car. Rare earth metals to manufacture electronics. The same logic applies to virtual resources.

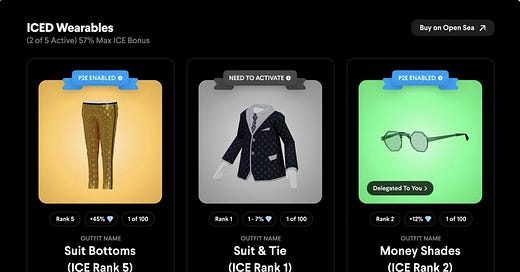

You need Ethereum (ETH) to transact and secure the Ethereum network. You need land before you can erect a building in Decentraland, and you need Axies and NFT wearables before you can play Axie Infinity and ICE Poker respectively. All of the above are examples of virtual resources.

The bigger the economies around Ethereum, Decentraland, Axie Infinity and ICE Poker get, the more demand there is for their resources.

I’ve started thinking more about the digital equivalence of land, sand and oil. And it could be as straightforward as virtual land, virtual sand and virtual oil. Virtual land already exists in Metaverse applications like Decentraland and the Sandbox, and things like Treasure DAO’s Bridgeworld have the concept of natural resources.

The first conclusion I’ve come to is that virtual resources will be more numerous for the simple reason that they are easier to create. Any engineer can do it, and there’s a toolbox in the form of smart contract templates at their disposal. Physical resources on the other hand, took millions of years to form. We can’t create more land, or sand :)

The second conclusion is that virtual resources will be both application specific and application agnostic. There are 97,000 unique plots of land in Decentraland, and 166,646 plots in Sandbox. These plots are only useful (and therefore valuable) in the context of their respective virtual worlds. However, there are resources like LOOT which are effectively open-source assets because they were created without a specific application in mind. It’s like creating characters without the context of a storyline, and hoping writers incorporate them into future screenplays.

The third conclusion is that demand for a specific virtual resource will change over time. Some resources have enjoyed perma demand - like water. As long as humans have been on this planet, water has been in demand. We need it to survive. On the other hand, resources like oil and rare earth metals weren’t in demand until we invented machinery and electronics that needed them. They’ve only been relevant in the last century.

All that to say, the demand for a particular resource is relative to time and circumstances, and the same will be true for virtual resources. Networks, applications and games come and go. The shelf life of a virtual resource is probably a lot shorter purely because the pace of innovation is so fast and our attention spans are increasingly short.

We might hold on to a house or commercial building for 50 years because we know it will always be in demand. I don’t think the same is true for virtual resources.

Ownership is Everything

We’re moving to an online economy based on digital asset ownership, and you need look no further than someone’s Ethereum wallet to be convinced of that. I don’t have a stat on this (I’ll try and find one for next week’s issue), but I am 100% confident that the average number of digital assets in someone’s wallet has increased exponentially over the last two years. NFTs guaranteed that.

So, ownership is on the rise.

Once you own something, the question becomes “what do you do with it?” Owning the resource gives you the right to dictate how that resource is used. Here are some examples…

Owning Ethereum gives you the right to (a) stake it for ETH 2.0, (b) lend it out and earn interest, (c) use it as collateral for a loan, or (d) pay gas fees on Ethereum. As the owner, you get to choose, and there is no right answer.

Owning virtual land gives you the right to (a) develop the land yourself, (b) lease it to a developer (like my friend), (c) sit on it, or (d) resell it on the secondary market.

Owning NFT wearables for ICE Poker gives you the right to (a) play the game yourself, (b) lend the wearables to another player in exchange for a percentage of their earnings, (c) hold them hoping they appreciate, or (d) resell them on the secondary market.

If you don’t own, you’re renting, or you’re not participating at all.

I’ve also been thinking about who owns virtual resources. Ownership starts out as a hobby. Then it becomes a profession. Then it becomes big business.

I’m an example of a hobbyist. My friend is an example of a soon-to-be professional, and EveryRealm is an example of a corporate/fund professionally investing and developing virtual resources like land. They also just raised $60M. $60M for a virtual real estate developer sounds crazy, but it’s not. It’s just early.

Parting Questions

I’m straying from the usual Parting Thoughts today and instead leaving you with a few questions.

Will virtual resource ownership be more or less concentrated than traditional resource ownership?

Who has an advantage, and who has a disadvantage, in terms of being able to own virtual resources?

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.

Another great article