I was in Tahoe last weekend skiing with a group of former colleagues. All of us are doing very different, but equally interesting and impactful things in the industry. We realized at dinner that between us, we have just about every corner of the Web 3 ecosystem covered (DeFi, NFTs, smart contract security, venture, mining/staking, large exchanges/custodians, institutional adoption, regulatory). Honestly, the only thing we’re missing is gaming/play-to-earn.

That diversity of experience made for great discussion. On our last night, we stood around the kitchen island and answered three questions:

What was the biggest surprise of 2021?

What are you most excited about in 2022?

What was your biggest L (loss) in 2021?

Everyone had very different answers (that’s what makes this group great). My answer to the “biggest surprise of 2021” was NFTs becoming social media PFPs. I’ve been following NFTs since 2017, I just didn’t see PFPs coming.

NFT PFPs are another case of “looks silly at first glance, but if you stare long enough, you see the future.”

All roads lead to your online identity.

Let’s zoom in…

Purchased + Earned

When most people think of NFTs, they think of high priced collectibles, digital art and famous memes. This is a gift and a curse. The gift is these NFTs are easy to understand and have mainstream appeal. You get it. You might not be willing to pay $100k, but you get it. The curse is the casual user and media think that’s all there is to it.

NFTs are an iceberg. What you see above the surface is a small fraction of what’s really there. Most of the mass is actually beneath the surface.

For purposes of this discussion, I’m going to organize NFTs into two categories: Purchased (above the surface) and Earned (beneath the surface).

Purchased. These are the NFTs the media covers. They are owner agnostic, and have a market price. They are assets. They signal what you like, or what you believe to be a good investment. Eventually, they will signal what you need too. Just like the broader crypto market, speculation has significant influence over this category of NFTs.

Earned. There’s more nuance to earned NFTs. They can be both owner-specific and owner-agnostic. To acquire them, you need to do something. Earned NFTs signal how you spend you time, your skills and experience, and accomplishments.

To get a complete picture of who I am, you need both.

Signals

The NFTs I purchase and earn can tell you a lot about the kind of person I am. Let’s look at two examples.

I purchased a Bored Ape. What does that say about me?

If I purchased it in April 2021, it signals I was early and I’m probably plugged into the NFT ecosystem. It signals I’m probably early to other projects as well. The fact that I still own it means I either think the value will continue to rise, or the social value of owning a Bored Ape is worth more to me than the dollar value of the NFT itself.

If I purchased it in January 2022, it signals I have $300k to spend on an NFT. It says I’ve made some money in or outside crypto.. It also says I bought for the same reason the other version of me who bought in April 2021 is still holding…I think it will increase in value, or the social value of owning the NFT is worth more than $300k.

I earned a Blue Pill NFT from Yearn. What does that say about me?

Blue Pill NFTs were issued to early Yearn contributors that participated in a variety of protocol activities. Possessing one means I was an early contributor to Yearn, and hold a certain status within the community. It may signal that I share some of the same beliefs as the founder and am aligned with the mission of the project. Depending on which Blue Pill NFT I received, I also may possess certain technical skills or experience.

This was a “back of the napkin” analysis, but the point is you can infer a lot about me based on two NFTs in my wallet.

Now assume there are hundreds of NFTs in my wallet…25% purchased (above the surface), 75% earned (beneath the surface). What I like, what I value, what I know and how I spend my time just became much clearer. It’s the equivalent of looking at my Linkedin page, investment portfolio, reading list, Spotify playlists and screentime app all in one.

What’s In Your Wallet?

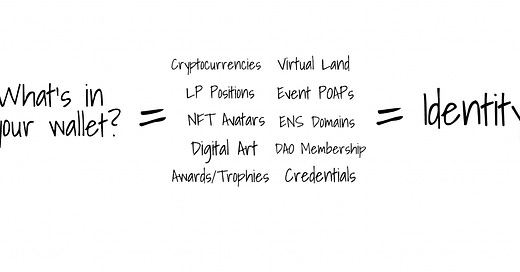

Your online identity is a compilation of what’s in your wallet. With the exception of stablecoins, cryptocurrency and other fungible assets, everything else is an NFT. Some you buy, some you earn, but collectively they tell a story about who you are.

Parting Thoughts

Identity theft has an entirely new meaning in the context of NFTs. If every NFT in your wallet is transferrable, your online identity can be irreversibly stolen from you, or at least erased. This impacts earned NFTs more than purchased NFTs. The NFT loses value when it’s no longer held by the person who earned it, and the person who earned it no longer gets the benefit of it. Everyone loses.

This is one of the best arguments for many earned NFT’s to be non-transferable.

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.

Solid piece. Great thinking about earned credentials provable on chain. And love the “what’s in your wallet” throwback.