Issue #53: NFT Royalties

In my 2022 Predictions post, I referenced Nike’s acquisition of design studio RTFKT, creator of popular NFT collections like Clones. I wrote that one of the benefits of owning the intellectual property behind a project like Clones is the right to receive royalties from secondary trading. Not only does Nike get one of the best design teams out there, but they get a perpetual revenue stream.

Any artist, whether they are creating music or a painting, wants their art to have a life of its own and be enjoyed forever. But they also want to be compensated when their work is enjoyed. Those two things - perpetual enjoyment and compensation - are often at odds.

The royalties RTFKT receives from Clones trading are called creator royalties, and they are emblematic of the “creator-first” culture we have in NFTs and Web 3 today.

Because so much of the value capture for NFTs happens from secondary sales, it has become common practice for NFT marketplaces to implement creator royalties in some form. They can be extremely lucrative for creators of blue chip collections, and in some ways they present an entirely new way of monetizing IP.

This is the topic of today’s issue.

Let’s zoom in…

Show Me The Money

I know most of you know this, but like any good lesson we’re going to define things first. A royalty is a payment made to someone for the use of their asset. If I create something, and you want to use it (especially in a commercial way), you need to pay me for that right. Royalties are often associated with the music industry, where recording artists and songwriters receive royalties when their music is played on the radio, streamed online, or performed, but they also apply to book sales, mineral rights (ex: oil and gas) and dozens of other types of property.

The first royalty-generating NFT I can remember was Ethmoji (2018), a now defunct NFT project created by Devin Finzer and Alex Atallah, the founders of Opensea. When they started, there were only a handful of NFT collections. To seed the ecosystem and stimulate activity on Opensea, Devin and Alex created Ethmoji.

The idea was simple - you could create custom emojis by choosing from a library of different traits (body, eyes, ears, mouth, hair and accessories) a la Mr. Potato Head. The novel part of the project was that each underlying trait (ex: the Donald Trump-inspired blonde comb over) was an asset owned by someone. When someone else incorporated a trait in their Ethmoji, the owner of the trait received a pro rata share of the minting fee, aka a royalty.

When I minted Ethmoji #504 below, my minting fee was split between the owners of the grey body, the brown hair, the winkey face and the upturned mouth.

Ethmoji was ahead of its time, and the per-trait royalty mechanism was a precursor to the creator royalty concept prevalent today.

Part of the “ownership economy” and “creator-first” culture in NFT’s is the belief that creators should be enjoying in the upside of the work they create. There was $13.5B of NFT trading volume in 2021, and most of the value capture comes on secondary markets. This has resulted in industry-wide adoption of creator royalties, where a percentage of the proceeds from secondary market sales goes back to the creator.

So how do NFT royalties work?

Imagine a Creator releases a new collection of NFTs and sells them directly to fans through the Creator’s website. After the initial sale, the NFTs start showing up on secondary marketplaces like Opensea. When the collection is officially listed, Creator and the marketplace agree on a royalty rate (ex: 5%). When a buyer purchases the NFT, the 5% royalty is subtracted from the total purchase price and paid to the Creator.

In most cases, NFT royalties aren’t embedded into the NFT smart contract itself. This is because blockchains can’t distinguish between a transaction where an NFT owner simply transfers the asset from one wallet to another, and a transaction where the owner actually sells the NFT. Instead, most royalties are implemented and enforced off-chain at the platform/marketplace level.

In other words, creator royalties are actually agreements between the creator and the marketplace middleman facilitating the sale.

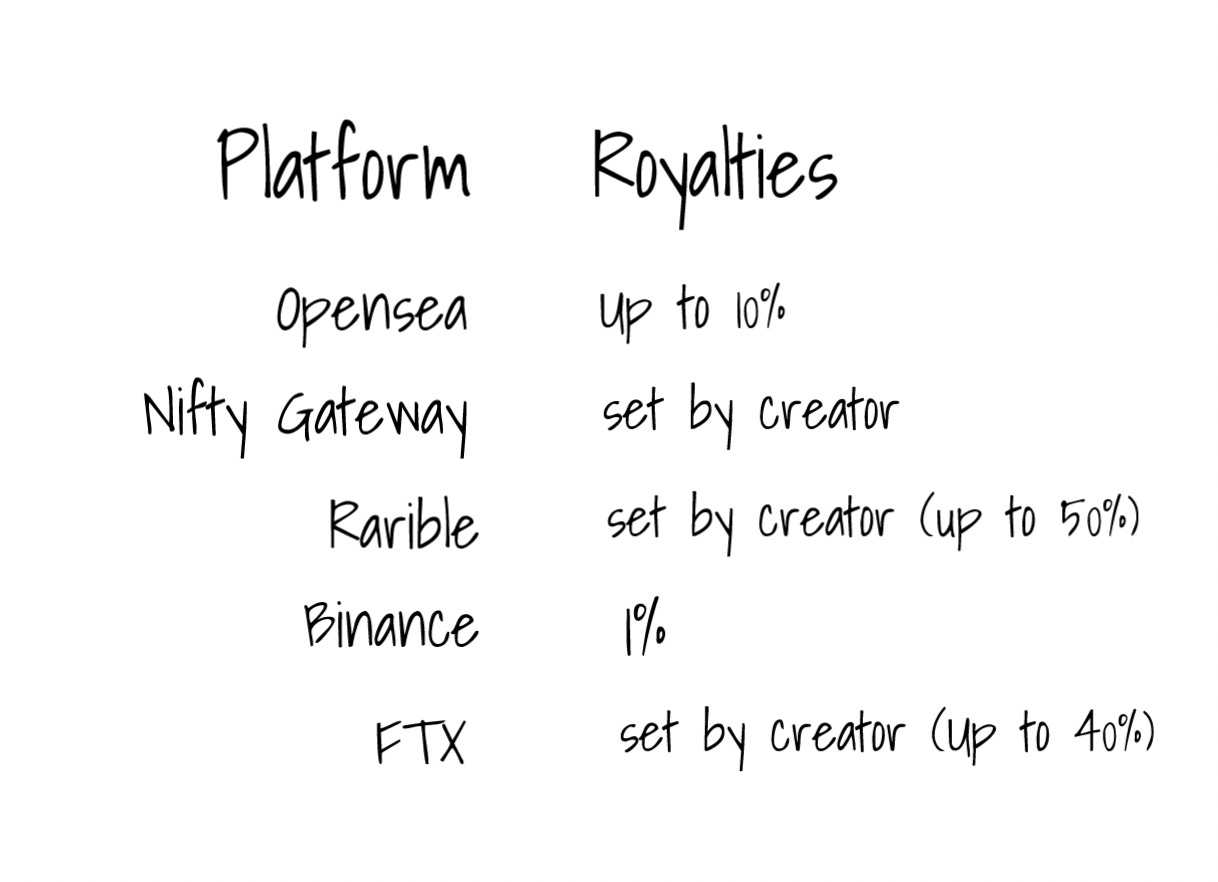

Now it would seem logical for royalty rates to be standard…every creator gets a 5% cut from sales, for example, but that’s not the case. Royalty rates are not global, they can and do vary by marketplace. Binance, for example, pays NFT creators a flat 1% royalty on sales. Opensea on the other hand, allows creators to set their own royalty, up to 10%.

Here’s a survey of royalty rates across some of the largest NFT marketplaces…

Cashing In

NFT creators are making real money off royalties from secondary market trading. I took a look at some of the most well known projects and summarized the accrued creator royalties to date on Opensea…

Most of these projects are less than a year old. It will be interesting to see whether they can maintain these revenue numbers in 2022. For most NFTs, there are two paths forward: fall into obscurity or become a highly coveted blue chip project. Both of which result in lower velocity, albeit for entirely different reasons.

This isn’t exactly an apples to apples comparison, but I thought it would be fun to compare NFT royalties with some of the top performing IP in the world…

Friends, one of the most popular sitcoms of all time, generates a reported $1B per year in revenue despite having been off the air since 2004. Each of the six cast members earn an estimated $20M a year from syndication royalties, and the three-person creative behind the franchise has earned an estimated $475M since the show’s final episode.

Mariah Carey’s rendition of “All I Want for Christmas Is You” has reportedly earned the singer $75M in royalties since it was released in 1994.

Seinfeld creators Jerry Seinfeld and Larry David each own 15% of the show’s back end equity, resulting in between $40-60M per year for each of them, primarily from syndication royalties.

Marilyn Monroe’s estate earns approximately $8M per year from the stars image, which is used to sell hundreds of products worldwide.

I think it’s important to start thinking about blue chip NFTs as brands and IP, in the same vain as popular songs, TV shows and iconic photos.

Beyond Secondary Sales

The royalty conversation is largely limited to secondary market sales today, but it will evolve alongside NFT use cases.

The creators of the two largest NFT collections - Bored Apes and Crypto Punks - have both signed management deals to expand their IP footprint into film, television and video games.

We’re also starting to see the commercialization at the individual NFT level. KINGSHIP, a virtual band comprised of four Bored Apes, recently signed with Universal Music Group. Other Ape owners have used their NFTs as the basis for new beer brands and comic book series.

This is where pop culture and NFTs collide, and where high value IP really shines.

Parting Thoughts

And no issue is complete without at least one reference to DAOs, so here we go…

Creator royalties get really interesting in the context of DAOs. Royalties accrue to the DAO treasury and are under the control of the DAO’s token holders. As you saw in the above chart, blue chip NFT projects are generating meaningful revenue from secondary market sales. NounsDAO is probably the best example of this today. Check it out.

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.

Andy! It’s your old law school pal Ben Elkin. Hope you’re well. Trying to get in touch with you. You seem to have a new number. I have the same number. Drop me a line. Wanna talk some business with you. :-)

Even though "royalties" for NFTs and IP are both referred to as "royalties", what do you think about the differences in their implementation? For NFTs you earn "royalties" from NFT transactions (the same NFT can't be "used" by multiple people at the same time) while for IP you earn "royalties" for their usage (many people can "use" IP at the same time).

These seem like pretty fundamental differences. One of them profits off of churn while the other profits off of usage.