Issue #45: The Lasting Impact of High Transaction Fees

I moved cross country (again) this week, so today’s issue was written by friend and former colleague @anonalyx. He explores the impact high ETH transaction fees has on user experimentation, education, and developer ingenuity.

It’s a good one.

—

Like most people in 2017, I bought bitcoin and every altcoin with wide-eyes and an open mind. I downloaded every wallet, used every exchange, and learned at an exponential rate. Then, in 2018, I got burned just like everyone else and watched as the market bled for the next 24 months. I closed shop, closed bids, closed mind, and moved on.

Despite working full time in crypto, I became completely disengaged from the technology and user experience. This is a dangerous place to be, because I lost personal perspective.

It took conscious effort, but this year I recommitted to being a user.

I was late to DeFi, but still interested in exploring the technology and understanding things like yield farming, impermanent loss and vampire attacks. I reached out to friends about what applications to use, what the mechanics of borrowing, lending and risk management were, and experimented with as many Web 3 products as I could.

I brought the keys out of cold storage, loaded up Metamask, navigated to Uniswap for the first time in almost 2 years, and…stopped.

Let’s zoom in...

The Cost of Doing Business

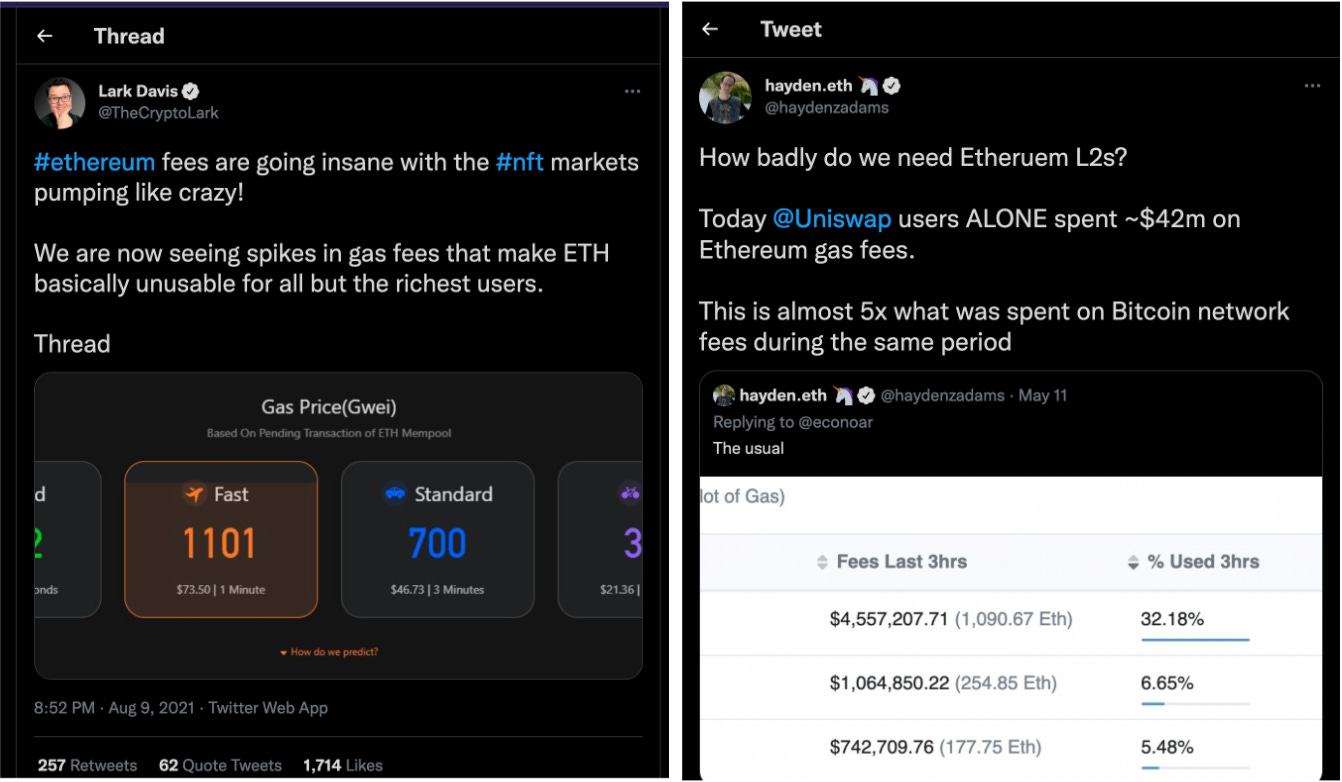

The dominant narrative this year has been Ethereum transaction fees. Two years ago, the average cost of an Ethereum transaction was $0.12. One year ago, it was $1.45. Today, it is $37. That’s a 30,800% increase over the last 24 months, and a 5,300% increase over the last year.

I don’t think I need a diagram to model this trend line for you. Ethereum block size is fixed. Demand for Ethereum block space is increasing thanks to DeFi and NFTs. This means users are competing with each other for limited block space with higher fees.

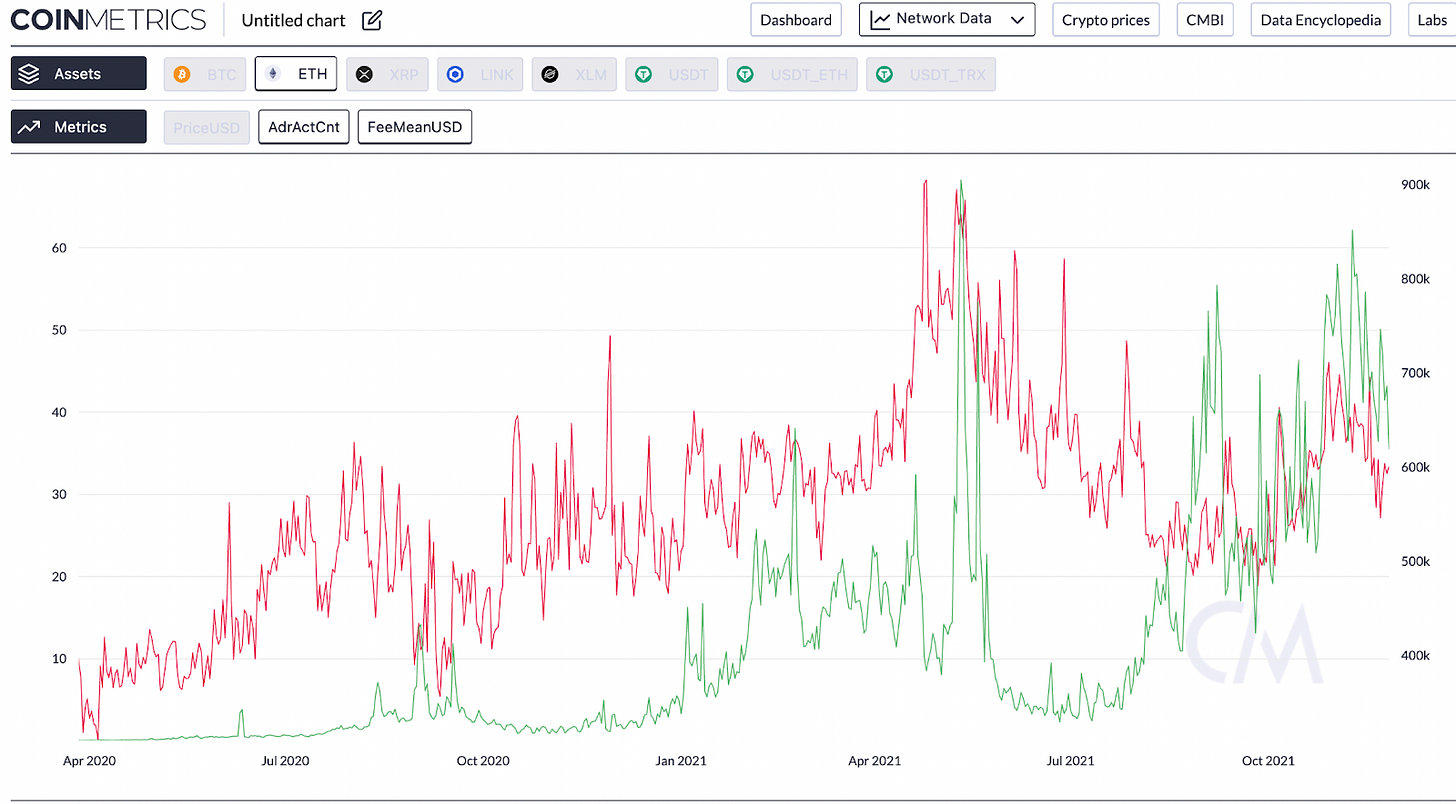

From almost every angle, high transaction fees are a problem. It hurts the user experience, prices large user segments out completely, and prohibits developers from experimenting. In the chart below, you can see that active Ethereum addresses peaked in May, and have declined and then stagnated at roughly the same level as Winter/Spring 2021.

High transaction fees on Ethereum are also driving a sea change, where a multi-chain future has moved from hypothetical to reality. Now, not everyone will agree with me that this transition is happening or that it is inevitable, and I totally understand where they are coming from. However, they are wrong.

There are plenty of examples of chains today with critical mass of users and product experiences that can be compared with Ethereum. Binance Smart Chain, Tezos, Solana, Avalanche, Polkadot, Harmony One, Cosmos and others are all viable base layers. Each chain has its own native user base, own community of developers, and a unique layer of applications. To dismiss these communities because EOS and other Ethereum killers failed in the past is to ignore why things really are different this time around.

In the next two sections, I will describe specifically why I think the impact of high transaction fees on user adoption and developer innovation is largely underestimated by the crypto cognoscenti.

Prohibiting User Experimentation

High transaction fees undermine Ethereum’s user experience in a systemic way. To bring this to life, let’s start with an example.

The screenshot below is what’s called an “approval transaction”. Before I can actually use a DeFi application, I have to execute a transaction giving the smart contracts within that application access to the specific asset in my wallet I want to use. In November, the average gas fee for a smart contract approval was $20. But that’s not the worst part. The worst part is that I have to pay smart contract approval fees for each asset I want to use within that application.

I haven’t even gotten to the point where I am using the service yet, and I’m being asked to pay up. It’s like being forced to pay a door fee for the privilege of speaking to the bank teller when all you wanted to do is withdraw $500.

This is an incredible headwind for user adoption, and forces me to ask myself a question that no product designer wants their users to wonder: “Is trying out this product worth the cost?”

Above all else, high gas fees discourage user experimentation. There are hundreds of products I have wanted to try on Ethereum that have no compliment on other chains, but at a certain point I can’t justify spending $100-$150 in gas fees in addition to whatever amount I am bound to lose in the “experiment”. So I just don’t do it, and miss out on the education and personal perspective. Multiply that experience by millions of new users finding crypto month.

Other EVM-compatible blockchains have the asset/application approval pattern I described above, and they all aim for the same solutions to that anti-pattern within the constraints of the Ethereum Virtual Machine: namely reducing fees and reducing time to finality. So, on Avalanche, Arbitrum or Fantom, these approval transactions aren’t nearly as noticeable, and on non-EVM compatible chains, the approval transaction is not always part of the transaction lifecycle. However, there is a risk with any of these chains that as usage increases, transaction fees will increase, and I expect they will be in a similar position as Ethereum. The point is, paying $100 for a swap on a decentralized exchange feels bad. Paying $20 for the privilege of paying another $100 for a swap on a decentralized exchange feels like extortion.

Tying this back to my personal journey, the only reason I have any experience using smart contracts on any other chain is because I was priced out of Ethereum. The first time I used Avalanche or Solana was following the market peak in May 2021, when I was so frustrated seeing that it now cost me more in gas fees to unwind myLP position on Sushiswap than I had received in rewards over the prior month. So I waited...months...until the math made sense.

That was the last time I used an LP product on Ethereum.

The Impact of High Fees on Innovation

Something else that I think is not well considered within the industry is how high fees shape the products that launch on each chain.

Today, the most interesting applications and the best designed products are Ethereum native. This is in part due to the maturity of the Ethereum developer ecosystem, but it’s also because low quality or high-risk projects simply can’t afford to launch on Ethereum. Ethereum isn’t nearly as saturated with derivative projects and low quality 10k pfp collections as say Solana, Avalanche, or Harmony One might be.

If you are a new developer exploring smart contracts and want to deploy a basic application with a few contracts to Ethereum, be prepared to spend upwards of $500 in gas for contract creation, memory allocation and other deployment fees. If you want to deploy a robust application with multiple smart contracts, be prepared to spend $5,000 or more. If you want to do something that’s truly boundary pushing, well… the sky’s the limit (source: How Much Does it Cost to Deploy a Smart Contract on Ethereum). To VC-backed teams, that is just the cost of doing business. To an independent developer, that’s a non-starter, and some percentage of those devs will go elsewhere.

In the end, I think this results in cheaper chains becoming the primary test ground for products and ideas that push the edge of innovation with a higher risk of failure, or have lower expected upside potential and may only ever expect to be worth less than opportunity cost of launching on Ethereum.

Additionally, certain products simply can’t exist on chains with high fees. For example, auto-compounded yield farming is a pretty obvious product that should exist on every chain with a DeFi ecosystem. For the uninitiated, let’s say you go to Sushiswap and create a liquidity position, stake those LP tokens, and start receive farming rewards. Those rewards have some distribution schedule - every minute, every hour, every day, or every week. Ideally, you wouldn’t have to manually claim and restake those rewards, the system roll those back into your LP position (aka compounding rewards).

However, because every transaction to claim and restake costs gas, and because the cost of gas > the reward amount in most cases on Ethereum, only large pools have the volumes and asset base needed to socialize the cost of gas for auto-compounding. Compare this to Avalanche or Solana, where auto-compounding is supported for the long-tail of asset pairs and liquidity pools, and provides a way for even small projects to incentivize user adoption.

There are more and more products launching on chains that require lower fees to be viable. As an additional example, it’s pretty much a given that any gaming project that is frequently writing data to the chain will need to live somewhere other than Ethereum. Axie Inifity is the most popular play-to-earn game in the world, and it runs on the Ronin blockchain. DefiKingdoms is a popular DeFi-meets-gaming simulation playable on the Harmony One network. I would expect that products on each chain continue to differentiate as they focus on the unique advantages that the underlying chain provides for their product.

Parting Thoughts

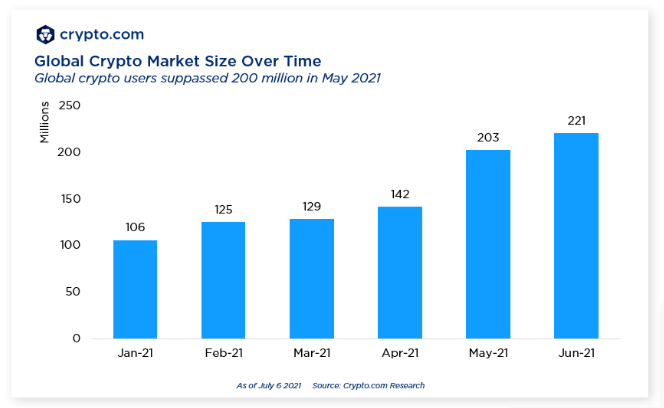

Why is this so important? Because crypto is in the middle of exponential adoption.

“Notably, it only took four months to double the global crypto population from 100 million to 200 million. By comparison, it took nine months to reach 100 million from 65 million since we began tracking these numbers.” - Source: Crypto.com Research.

If we analogize the adoption rate of crypto to the adoption of the Internet, then within the next 12 months we will have doubled the number of crypto users world-wide from 200 million to 400 million. How many of those users will have done an on-chain transaction on Ethereum? How many of those developers will find the cost of contract deployment to be unpalatable, and turn to alternative Layer 1s even though the developer tooling is less mature? If Ethereum scaling technology is still 9 months out from providing the user experience that alternative Layer 1s provide today… then how many millions of users and developers will find their home on one of these other chains and never look back?

I know I sound bearish on Ethereum, but I’m not. My personal point-of-view is Ethereum has a bright future catering to institutions and high-net worth individuals that need to transact on the most credibly neutral, censorship resistant, and only proof-of-work smart contract chain on the market today. However, I think it’s important to realize that crypto is so successful because it is tribal, because it’s emotional, because we get it right one time and hope that we never have to get it right again. Ideological fervor drives adoption and builds antifragile systems in the short-term, but it also blinds adherents to the ways that the world is changing beneath their feet in the long-term.

If you leave this article with one key conclusion, it’s that the highest ROI for your time is being an indiscriminate user with an open-mind.

Thanks for reading.

—

Not a subscriber? Sign up below to receive a new issue of 30,000 Feet every Sunday.