Issue #4: Commoditizing Trust

Why the financial services industry should be excited and scared about DeFi

From 30,000 Feet

The Internet commoditized content distribution, forcing media companies to find a new competitive advantage. With the help of blockchains, the Internet’s second act is commoditizing something the financial services industry has built a business model around - trust. Decentralized Finance supercharges blockchains ability to provide trust, adding infrastructure that enforces the terms and conditions of the most common financial arrangements.

Let’s zoom in…

My objective with this issue is for you to walk away after reading saying “I understand the DeFi and the impact it will have on financial services”. This is a tall task, but I’m up to the challenge.

To start, I want to revisit the Internet history lesson from previous issues. Blockchains and DeFi are part of the Internet, after all.

Looking backwards

The Internet is a combination of hardware (fiber optic cables spanning the oceans, telephone lines, routers) and protocols (rules dictating how data gets passed around the network and ultimately ends up on your computer screen).

Hardware and protocols, that’s it.

The hardware and protocols work in concert to distribute information around the world hyper efficiently. Put differently, the Internet is the largest, most efficient information distribution system in the history of the world.

The impact of a global information distribution system was immediately felt by industries with business models built around content distribution - newspapers, radio stations, movie studios, and record labels.

Let’s look closer at the newspapers.

Newspapers had a simple business model - employ an army of journalists to create quality content on timely topics, and physically distribute a daily collection of that content to as many readers as possible.

Distribution is expensive though. You need paper, ink and giant machines to print thousands of copies every day. You also need a fleet of delivery trucks, drivers to drive the trucks and a network of on-foot delivery men and women to get newspapers to readers’ driveways, doorsteps and lobbies.

For decades, distribution was a barrier to entry into the newspaper business, and a competitive advantage that kept the largest newspapers from being disrupted.

One day, a technology came along that provided low cost, fast, global distribution.

The Internet.

Suddenly, newspapers’ barrier to entry and competitive advantage was gone. Now anyone with a point of view or something to share had a way to distribute that perspective to an audience. This gave birth to a generation of companies focused on helping people distribute their points of view to an audience (Facebook, Twitter, Instagram, Medium, Substack).

The Internet also changed what kind of content could be distributed. In the past, because distribution was expensive, content publishers focused on content that had broad appeal. If you are spending a lot getting your content out there, you want to maximize your reach (and profit). The fixed costs are already high, and every new reader costs $X more.

But if distribution is free (or close to free), the business model changes and publications with a niche focus can survive and prosper.

I’m a beneficiary of this disruption. Without it, 30,000 Feet wouldn’t exist.

In summary, the Internet monopolized a core part of the content publishing value chain, disrupting many industries and birthing many more.

History doesn’t repeat itself, but it rhymes

The Internet is disrupting finance the same way it disrupted media - by commoditizing a feature at the core of the industry’s value proposition and competitive advantage - trust.

At first thought, trust may not seem like something commoditize-able. It’s a feeling, after all. “I trust this person”.

But many industries, including financial services, have commercialized trust. Banks sell trust. If you deposit $100 dollars into a bank today, you can withdraw your $100 tomorrow.

There’s a reason you don’t keep your money with Bill down the street. This kind of trust is based on reputation and brand name, the size of a balance sheet and regulation, and has traditionally been reserved for institutions.

Not anymore.

Armed with blockchains, the Internet is commoditizing trust.

Blockchains, as the ledgers (or accounting systems) for the Internet, enable it to manage the supply and ownership of scarce digital things (e.g. cryptocurrency). Now, two people who don’t know each other, and certainly don’t trust each other, can transact with one another over the Internet.

Don’t get me wrong, transferring value around the Internet peer-to-peer is a gamechanger. But, a lot of financial transactions involve more than just sending value from A to B. They involve conditions, interest rates, maturity dates, penalties, restrictions, regulatory requirements, and a host of other terms and conditions. Can blockchains and the Internet provide trust in these contexts too?

DeFi - trusted “terms and conditions”

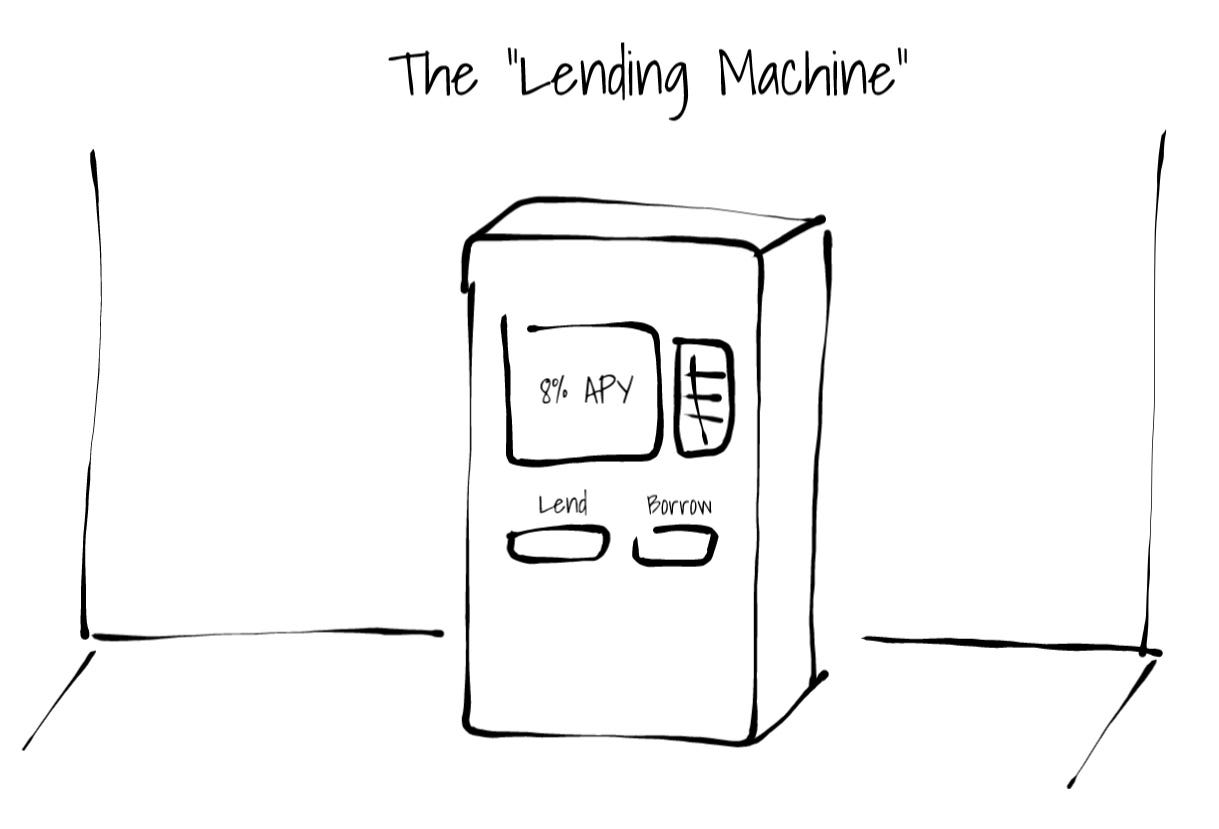

Imagine you are standing in front of something that looks like a vending machine. Except, this machine doesn’t dispense chips and cans of soda. This is a lending machine! It accepts dollars through one slot, and dispenses dollars through a second slot. The first slot is for customers who want to lend their money (lenders). The second slot is for customers who want to borrow money (borrowers).

You walk up to the lending machine and press Borrow. A message flashes on the screen…“How much would you like to borrow?” You type $10,000. An interest rate flashes on the screen…”8% APY”. A few seconds later, it asks you to “Please deposit collateral” (it doesn’t know who you are, or your creditworthiness, so collateral is necessary).

You enter your collateral into the first slot, and your $10,000 dollars is immediately dispensed from the second slot. You get a receipt that reflects your loan balance and interest rate. At any point in the future, you can come back to that machine, scan your receipt, deposit the $10,000 in the first slot, with interest, and retrieve your collateral from the second slot.

In reality, this lending machine is a protocol - a tiny software program that lives on the blockchain (in the form of a smart contract(s)). It is designed to do a very specific thing - take money in, lend money out with interest, and hold collateral. We trust that it will do these things, and only these things.

This is decentralized finance (DeFi).

DeFi has been around for almost four years, and there are many other “machines” living on blockchains now. Like the Lending Machine, each one enforces a specific set of rules on the assets it interacts with. Some act like central banks, others act like exchanges, hedge funds, or insurance companies.

If blockchains are the foundation of our “house of trust” on the Internet, DeFi is the kitchen, living room, and bedrooms. It adds a layer of context by standardizing and enforcing a specific set of terms and conditions.

I’m not just transferring money to you, I’m transferring it at 8 percent interest over the next year.

I’m not just sending you this digital asset, I’m sending it with the expectation that I will receive another asset of equivalent value back simultaneously.

Each arrangement is enforced by a DeFi protocol.

We trust these DeFi protocols for the same reason we trust blockchains. We trust code to execute properly, and we can test it! Like blockchains themselves, the largest DeFi protocols also have an increasing history of just…working.

And like the blockchains they live on, DeFi protocols should be thought of as public utilities, accessible by anyone with digital assets.

Users of these public financial utilities are primarily individuals today, but a growing number of crypto companies and hedge funds have started using them as well. Over the next decade, DeFi protocols will become the plumbing for the next generation of our financial system.

The Predictable and Unpredictable Impact

Predictable - Just like newspapers were forced to find a new competitive advantage after distribution was commoditized, companies whose business model is based on providing trust in the context of financial transactions (e.g. banks, custodians, transfer agents, trustees, central securities depositories), will be forced to find a new value proposition. The most forward thinking of these organizations already know this, and are strategizing accordingly.

Unpredictable - It’s hard to say where the dust settles. Blockchains and DeFi are open protocols…public utilities. Incumbents and challengers have the same right and ability to use them or not.

The question becomes…when a 100 year-old bank, a 10-year old fintech, a 6-month old startup and an individual have access to the same financial infrastructure, what happens? And who wins?

A newspaper company could have built Facebook, Twitter, or Instagram, but it didn’t…

Thanks for reading.

Andy

Not a subscriber? Sign up below to receive a new issue every Sunday! Be on the lookout for next week’s issue, where I explore the impact of crypto trading on your psychology (and why it’s worse than social media).

Very interesting perspective. The only hiccup I see is the devil that lives in the details for end-users. DeFi protocols are only as secure as the smartcontracts their made of. Very few "users" have the technical capability to understand the code well enough to determine if it is securely written. In other words, a user might say, "I understand the theory of this DeFi product, but can I trust this particular protocol was written in a secure and honest way-- without any backdoors or exit scams" As a non-developer end-user, I would still need to be able to trust the protocol the same way I trust my bank. Because of this, trust may still be a relevant differentiator even in DeFi. Or am I missing something or is there a way for this to be overcome? Keep it up, Andy!