Issue #32: Decentralized M&A

Mergers and Acquisitions was my favorite class in law school. For whatever reason, business and corporate law made sense to me. Evidence and Constitutional Law did not…hence why I became a corporate lawyer.

I spent the first 3.5 years of my career doing a combination of corporate and regulatory work for crypto companies, and buy-side M&A, meaning we represented the buyer. I learned a lot about why deals happen, why they fall apart, and compromise.

In crypto, most of the M&A activity has happened in the last four years, and the large exchanges - Coinbase, Binance, Kraken and Gemini - are responsible for a majority of the deals. These deals look like any other non-crypto deal - one company acquiring another in consideration for cash or stock (or in the case of Binance, BNB tokens). A purchase agreement is drafted, representations, warranties and convenants are negotiated, the agreement is signed. A few weeks later, the deal closes. Textbook acquisition.

During those same four years, DeFi went from nothing to a $100B ecosystem. These protocols are big business now, generated millions, and in some cases billions, in revenue per year. In a bull markets, these projects also have enormous treasuries that need to be spent. As DeFi projects compete more aggressively for users and liquidity (especially the institutional variety), M&A is inevitable.

Will decentralized M&A look any different?

Yes and no.

Let’s zoom in…

Why Deals Happen

We see the announcements in the news all the time. So-and-so is acquiring so-and-so in a deal worth $X. But why? What fuels M&A activity?

A desire to grow and competition.

The purpose of a merger or acquisition is to grow a business faster than it could organically. Sometimes it’s a company buying a competitor (acquisition). Other times it’s two complimentary or competitive businesses joining forces (merger). Whatever the scenario, the intention of the deal is to increase the size or strength of the surviving company.

Growth isn’t one size fits all. Companies want and need to grow in different ways.

Talent. Sometimes, growth requires specific people with specific skills. A lot of acquisitions in tech are what we call “acqui-hires”, where the purpose of the deal is really to acquire the people from the target company. It’s a clever way of getting startup founders to quit their jobs and come work for you.

Capabilities. It can be easier to buy a complimentary business than to build it from scratch. Many of the deals Coinbase, Binance, Kraken and Gemini have done over the last four years have involved new capabilities.

Market share. Acquiring a competitor to grow is often faster than acquiring users organically. It can also be more nuanced - for example, acquiring a competitor in a specific geography to take advantage of their regulatory licensing and local presence.

For an active M&A market, you also need a sufficiently mature and competitive industry. Acquisitions cost money. Not only do you have to pay for the assets or company you’re buying, you have to pay lawyers, accountants, and maybe an investment bank. Early stage companies generally don’t have the balance sheet to make acquisitions. A healthy M&A market requires larger companies with money to spend. It takes new industries years to mature to this point.

You also need competition. If you’re the only company operating in a market, it can be a sign the market isn’t big enough to support competition. Without competition, there isn’t pressure or an incentive to grow faster than you could organically.

For the first eight years of crypto, there were very few acquisitions. Companies weren’t large enough, and the market wasn’t big enough. Since 2017 however, there have been several periods of consolidation where larger companies scoop up smaller or complimentary businesses. It happened with exchanges like Bitstamp and Poloniex in 2018, with custodians like Xapo and DACC in 2019, and with price tracking tools like Coinmarketcap and Blockfolio in 2020.

Decentralized M&A

DeFi projects have the same needs. They want to grow, and they need talent, capabilities and market share to do it. At the same time, the market is becoming increasingly competitive, and these projects are flush with capital. It’s a perfect storm for M&A activity.

How these deals are structured and get approved will be fascinating.

Putting the Balance Sheet to Work

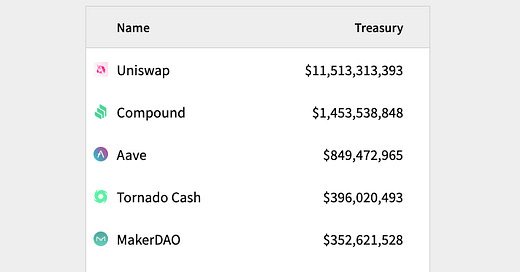

Despite only being a few years old, the DeFi ecosystem has serious money to spend. The largest DeFi projects have billions in their treasury earmarked for community growth and engagement.

In the last year, there have been two examples of decentralized projects using their treasury for M&A activity:

Yearn <> Sushi

While not a true acquisition, Yearn partnered with decentralized exchange Sushiswap in December 2020. The arrangement included a token swap from the teams’ respective treasuries. The Yearn treasury received an amount of SUSHI, in exchange for an amount of YFI for Sushi’s treasury. After the swap, both projects now have a meaningful financial interest in the others’ success, as well as an ability to participate in governance.

Polygon <> Hermez

Polygon, a layer 2 scaling solution for Ethereum, recently announced the acquisition of Hermez, a blockchain network leveraging zero knowledge proofs. This was a proper acquisition in the sense that Polygon is acquiring everything - talent, technology, and Hermez’s native HEZ token. The deal was worth approximately $250M at the time of announcement and financed completely by Polygon’s MATIC token. The purchase price represented 10% of Polygon’s treasury, and 2.5% of the total token supply.

I’m very interested to see how the integration and token redemption goes. If things are smooth, expect it to serve as a template for future deals.

If there was a purchase agreement, even an LOI, associated with this acquisition, I would love to see it…

Thumbs Up from Tokenholders

In the corporate world, certain decisions outside the ordinary course of business require shareholder approval. Things like selling all or substantially all of a company’s assets, or issuing a chunk of new shares, thereby diluting existing shareholders. And it makes sense. These decisions have a material impact on the future and health of the business.

Should tokenholders have similar rights?

Probably, eventually.

When Yearn announced the string of “acquisitions” last year (Cream Finance, Pickle, Cover Protocol and Sushi) tokenholders were not sought for approval. After the announcements, some understandably felt cut out of the process. The fact that tokenholders weren’t consulted prior to those deals being announced highlights a reality this industry tries to ignore. As much as we want to believe all of these projects are decentralized, the truth is they aren’t. They are controlled by a group of insiders made up of founding team members and early investors.

For the record, I think insider control is a good thing, especially while these projects are still maturing. But let’s call a spade a spade.

Another reality is DAOs don’t have articles of incorporation and bylaws specifying exactly when tokenholder approval is required. I expect the equivalent to be crafted for DAOs soon, especially as projects get more creative with how they use their treasury.

Another side effect of requiring tokenholder approval is the public nature of the approval process. It’s impossible to get a deal done without advertising it to the world, and your competition.

I’m going to think more about the implications of this.

What Are You Buying?

In traditional M&A, there are two types of deals - asset deals and stock deals. In an asset deal, you are buying specific assets from the company (IP, customer contracts, inventory, real estate, equipment, etc.). In a stock deal, you are buying the company, which includes all the assets but also all the liabilities.

DeFi M&A is different because (a) there aren’t companies, there are protocols, (b) the protocols are open source.

Since the code is public, what else could you acquire?

Tokens. The closest thing to a stock deal in DeFi would be a token deal. Assuming the target has a robust governance structure that grants tokenholders significant say over the protocol, you could purchase a majority of the tokens off the market, thereby owning a controlling stake in the DAO.

Again, assuming the target’s tokenholders have significant say over the protocol, owning a controlling stake of the token would allow you to exercise control over the protocol contracts and treasury. You effectively own the protocol at that point, and your tokenholders could govern the purchased protocol.

Collaboration and Integration. The closest thing to buying capabilities is perhaps buying integration and collaboration. This is what Yearn did through deals with Cream, Pickle, Cover and Sushi last year. These deals weren’t true mergers or acquisitions, they were agreements to collaborate on strategic integrations with the other projects and tokens. A good analogy here are airline partnerships - Star Alliance, One World and Sky Team. The airlines and their shareholders remain separate, but they agree to work together to provide global route coverage for their mutual customers.

Parting Thoughts

Bull markets don’t last forever, and they are always followed by a prolonged “winter”, where token prices drop and trade sideways for a few years. Normal market cycles.

Winters are hard on a lot of projects. Growth stalls and revenues decline. It’s also a catalyst for a frenzy of M&A activity, as bigger companies scoop up competing or complimentary projects at a discount.

In preparation for another crypto winter, Coinbase announced it has stockpiled $5 billion in cash so it can continue being aggressive in the next bear market. Assume acquisitions are on the table.

DeFi projects and DAOs should take notice. If you have managed and diversified your treasury wisely, you can be aggressive. If not, you may be looking for a lifeboat.

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue every Sunday.