Issue #31: Emulation, then Innovation

I read a great quote recently from jazz legend Miles Davis…

“It took me years to learn to play like myself.”

What Davis meant was he spent years emulating other people before he found his own sound. If you’ve ever learned to play a musical instrument, you know the easiest way to learn is by practicing other people’s songs. If you practice enough, those pieces of inspiration combined with life experiences can come together in an elegant way to produce something original.

It takes years to be an original. To innovate.

Technology compounds and evolves in a similar fashion.

Critics of blockchain technology often say our industry is just emulating on top of blockchains everything our financial system already has.

They’re not wrong.

Whenever a new platform for innovation comes along, be it the Internet, the mobile phone, or blockchains, the first thing we do is replicate things we already have on the new platform.

The first websites were digital versions of encyclopedias, magazines and newspapers. It would be a decade or more before social media and the creator economy were created.

Our industry is collectively learning to play a new instrument. We were given blockchains and cryptocurrency and told to “go build something” that changes the world. So like a child learning to play the piano, we started building businesses that had analogies in the traditional financial system. Those businesses solved a problem and delivered enormous value to users.

Once the industry had a good handle on the fundamentals, it started to find it’s own sound. Entrepreneurs experimented with components that were native to blockchains, like smart contracts, and a new door of innovation opened up, one we couldn’t see ten years ago.

We are approaching the end of the emulation phase, and starting to build things uniquely enabled by this technology.

Let’s zoom in…

Emulation

For the majority of the last decade, this industry has built the same businesses for cryptocurrency that exist for other asset classes.

Ten years ago, Bitcoin was not easy to acquire. You either had to mine it yourself, or buy it from someone who had. Mt. Gox, the first cryptocurrency exchange, launched in July of 2010. Two years later, a company called Coinbase was founded in San Francisco. Since then over 600 exchanges have launched around the world.

The exchange solved a major paint point around access and liquidity, and is no doubt the defining business of this industry.

So far.

Despite runaway success, there is nothing particularly novel about the cryptocurrency exchange business model. Exchanges let users create accounts, hold assets on the platform, and buy and sell. For all intents and purposes, they do exactly what a stock trading platform does…but for crypto.

The fee-based, brokerage platform model has been around for a while. When you trade stocks, you pay fees. When you trade crypto, you pay fees. Brokerage platforms, whether it is Coinbase or Etrade, take a fee for being the middleman.

Exchanges are the best example of emulation, but they aren’t the only example.

Take a look around. The largest companies in this industry have the same business models as their non-crypto brethren…the ________ for digital assets.

The [exchange] for digital assets.

The [custodian] for digital assets.

The [prime broker] for digital assets.

The [bank] for digital assets.

The [payment processor] for digital assets.

The [hedge fund] for digital assets.

Why is this?

It’s pretty simple. As an entrepreneur starting a business, you see a problem you want to solve. How you solve the problem is based on the tools you have available. In the early days of crypto, there were obvious problems and inefficiencies in the market. The limiting factor were the tools available to solve it.

Back then, it was single asset blockchains and cryptocurrency. That was it. Ethereum, smart contracts and DeFi didn’t exist. So entrepreneurs solved the problems and inefficiencies in the market with the tools they had - existing business models. Wall Street gave us the playbooks, and we applied them to a new asset class.

These businesses have been successful and delivered enormous value to users. But they aren’t the end game. They are the warm up.

Like a musician, we needed to emulate before we could innovate.

Innovation

In 2021, our toolbox for solving problems and inefficiencies is much bigger than it was a decade ago. Emulating Wall Street’s playbook doesn’t make much sense anymore.

I can’t predict the net new innovation we’ll see over the next 20 years. But what I can take a swing at is identifying some of the building blocks that will enable it.

Smart contracts

Cryptocurrencies, NFTs, DeFi, DAOs.

Smart contracts are the stardust of the crypto world. The bricks for our crypto house.

In a discussion about building blocks of innovation, smart contracts are quite literally the building block behind just about every buzz-acronym in the industry.

It is remarkable that one thing can have such broad use. But another way to think about smart contracts is as blockchain-native software programs. And the software can be written to do whatever you want it to do.

Manage the supply and ownership of a new digital asset…check.

Facilitate peer to peer lending and borrowing activity…check.

I’m not a software engineer, but I have to imagine smart contracts is the most exciting innovation in financial software engineering ever.

We’ve only scratched the surface on what can be built with smart contracts.

DeFi

DeFi is itself a net new innovation, but since it already exists, I’m cheating and using it as one of my building blocks. Benefits of being the author.

Permissionless financial infrastructure. Those three words didn’t belong in the same sentence a few years ago. Today, we have it.

DeFi is permissionless financial infrastructure - meaning any person, organization, application and asset can use it without asking.

It’s hard to comprehend and quantify the impact of this. I’ll admit right here, I can’t do it.

Right now, DeFi is a small but growing corner of the crypto market, and it will run face first into the regulatory wall over next few years too. Security issues plague the ecosystem on an almost daily basis, and the user experience leaves A LOT to be desired. But…these are growing pains. Temporary, not debilitating.

I can’t predict everything a permissionless financial infrastructure enables, but I know its impact will be comparable to the Internet.

Metaverse

If you’ve read the book or seen the movie “Ready Player One”…it’s the Oasis.

The metaverse is the term used to describe the growing landscape of shared virtual spaces, encompassing popular games like Roblox, decentralized worlds like Decentraland, and Facebook’s ambitious VR project Horizon.

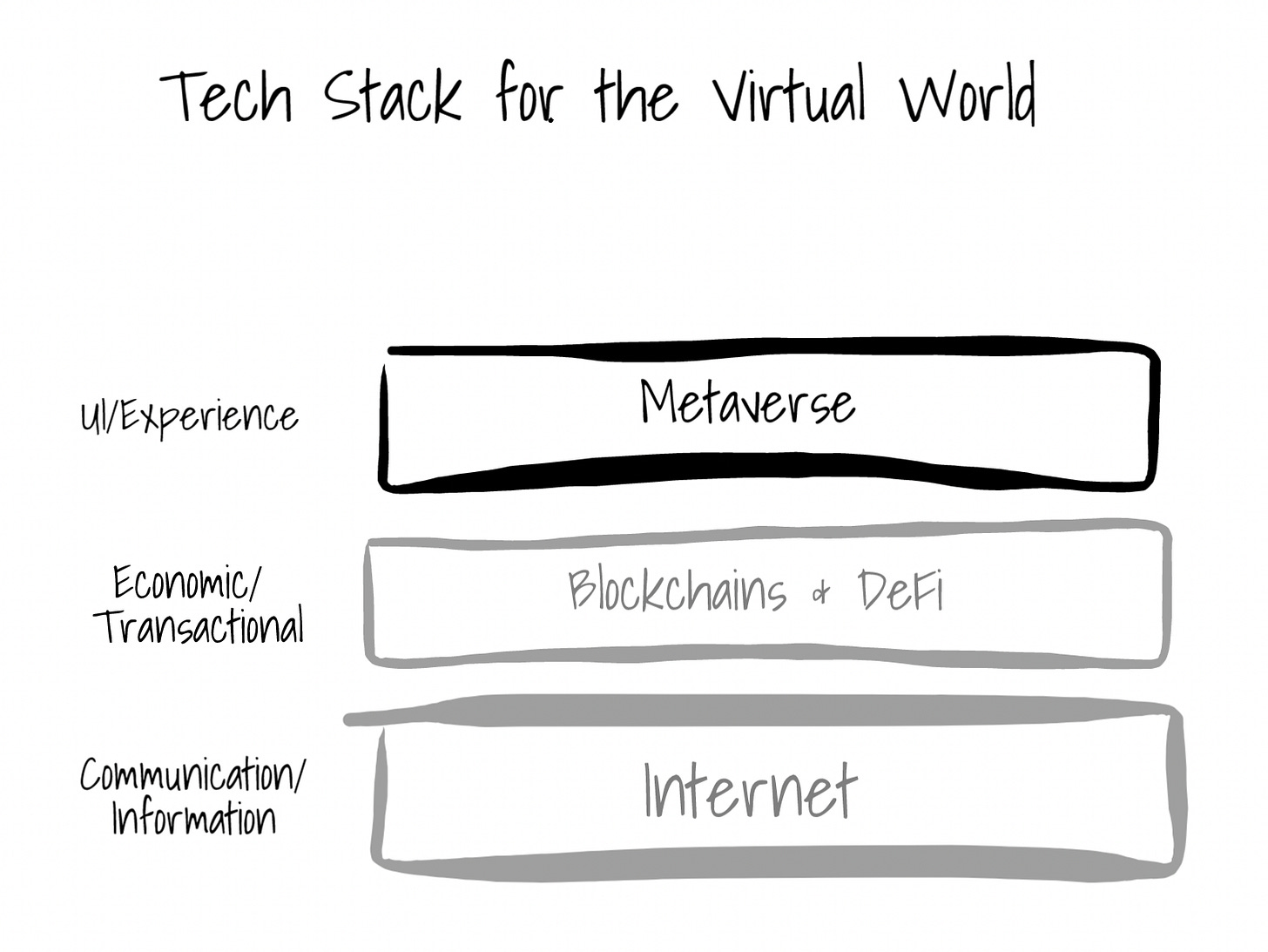

I think of the metaverse as the 3D user interface for the Internet.

For almost 30 years, we’ve used browsers and webpages to interact with the web. That experience is sufficient for reading and watching content. Creating a three dimensional world to read the news isn’t necessary or practical.

But the Internet isn’t just supporting newspapers and videos anymore. It supports a growing chunk of our social and professional interactions. We are rapidly approaching a point in time where our virtual interactions outnumber our physical ones. In that reality, it seems intuitive that the virtual world would have an immersive, visual component.

Virtual reality hardware has been around for a while, but the technology is finally good enough and cheap enough to be widely adopted. VR devices will be the primary way through which we experience the metaverse.

Something I’m going to explore in a future issue, but this is how I’m currently thinking about the tech stack for the virtual world.

DAOs

In a world where potentially every individual on the planet is virtually connected, we need reliable mechanisms for organizing and directing capital and human effort that transcend geographies, language and the need to trust someone.

Twenty years ago, you would start a company to accomplish this. Today, we have DAOs, the Web 3 company equivalent that are made up of the same stuff everything else in this crypto world is - smart contracts and tokens.

I don’t know if the DAO moniker will stick long term, or if we’ll end up calling them simply organizations, but I do know that among entrepreneurs in this industry there is already a preference to forming a DAO instead of a Delaware corporation.

That is telling of the future of work and coordination…

Parting Thoughts

I picked four building blocks - smart contracts, DeFi, the metaverse and DAOs - but there will certainly be others. Smart phones and whatever the next iteration of mobile hardware is will be another important ingredient. Social media and the Creator Economy appears to be on a collision course with blockchains too.

I’ve never been more excited about the possibilities.

Thanks for reading,

Andy

—

Not a subscriber? Sign up below to receive a new issue every Sunday.