Issue #3: Why Exchanges Should Care About DeFi

As some of you know, my girlfriend and I have been crisscrossing the country in our SUV, staying in Airbnb’s in a different city every month. We arrived in Santa Fe, NM last night and so far so good. I’m convinced I write better at altitude (and definitely after an Old Fashioned).

I can also confidently say after working on this newsletter for the last month that I’ve never had more fun. So thank you for supporting something that brings joy to my life.

----

Let’s dive in…

In previous issues, I’ve talked about exchanges and DeFi. This week, I want to talk about both, and specifically why DeFi is both the biggest opportunity and biggest threat for cryptocurrency exchanges.

It’s a Love/Hate Relationship

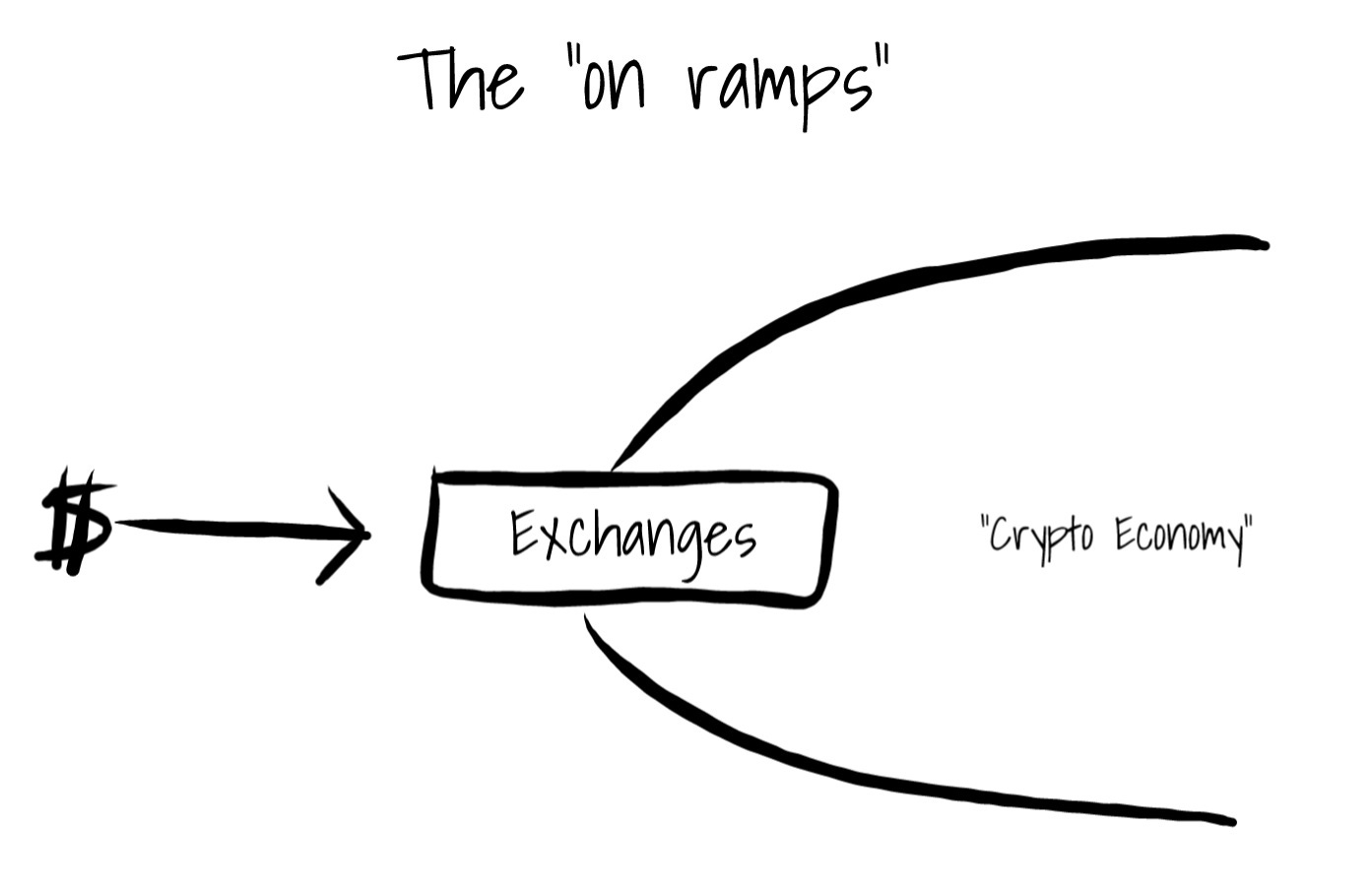

Exchanges occupy a critical, and lucrative, position in the market today. They serve as “on ramps”, onboarding users en masse into the crypto economy. “Bring your dollars, and we’ll help you convert them into digital assets”. Without exchanges, buying Bitcoin and Ethereum would be too difficult for most people.

The cost of doing business and collecting transaction fees is complying with various regulations, including identifying customers and monitoring for suspicious activity (i.e. money laundering).

Once users are in (aka own crypto), they can access an entire ecosystem of financial products and services.

As I talked about in my first issue, the newest and most exciting batch of financial products and services native to the crypto economy is collectively referred to as DeFi.

DeFi is really two things: infrastructure and products & services. The financial protocols (for asset exchange, lending, central banking, insurance, hedge funds, derivatives…) are infrastructure; financial utilities that by virtue of living on public blockchains are now part of the broader Internet infrastructure. The applications built on top of DeFi protocols are the user-facing products and services.

The relationship between exchanges and DeFi is one of love and hate, and ultimately of dependency. DeFi is crypto-native, with no direct bridge to our current financial system. Exchanges on the other hand, “straddle the fence”, with one foot in our current financial infrastructure (i.e. fiat currency), and the other foot on blockchain infrastructure (i.e. crypto). Because users need crypto before they can access DeFi, DeFi needs exchanges to bring net new users and liquidity into the ecosystem. “We love them because they do our dirty work for us (regulatory compliance), but we hate them because we can’t do it ourselves”.

This is the crux of the opportunity and threat.

The Opportunity

Exchanges have a rare commodity in the market today – users. More so than any other business model in crypto, exchanges have product-market fit. The largest exchanges have tens of millions of users each, dwarfing the largest brokerage platforms like Schwab and Robinhood. And the recent momentum in the market has opened the flood gates, with some exchanges reporting 100k new signups per day.

At the same time, DeFi is pumping out new infrastructure and commoditizing a different vertical of financial services seemingly every day. The Internet’s financial toolbox is getting really, really BIG.

So what you have is a growing user base on one side, and a growing set of financial plumbing and services on the other side.

What’s an exchange to do?

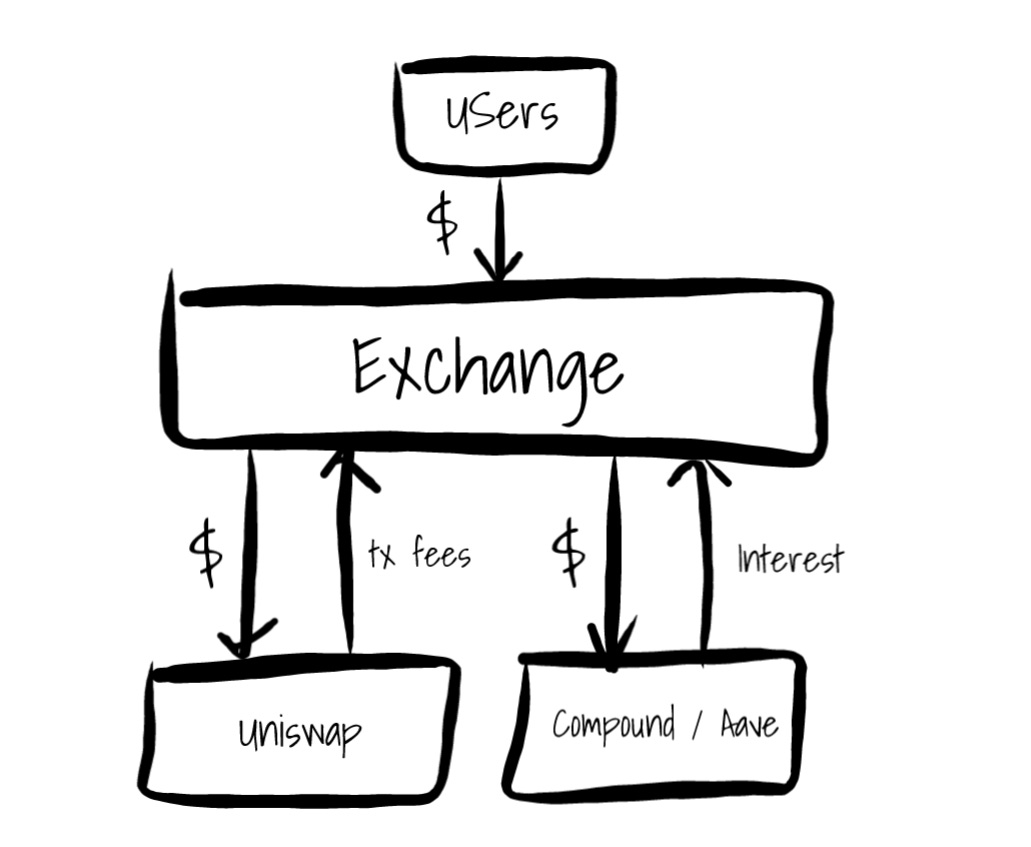

To date, most exchanges have listed DeFi tokens (the governance tokens for DeFi protocols). Low risk and not particularly interesting, but a predictable first step. Where this gets exciting is when exchanges decide to sit in the middle, and funnel either users, but more likely capital, into DeFi protocols. Here’s how it could work:

Users keep stablecoins and crypto on the exchange

Exchange offers users a liquidity mining product (via Uniswap) and a high interest savings wallet (via Compound or Aave)

Exchange aggregates user funds and provides liquidity to all three protocols

Exchange earns transaction fees from Uniswap, and interest from Compound and Aave

Exchange passes a percentage of the fees and interest on to the users

This is a win-win. Exchanges provide what they are good at: users, user experience, insurance and customer support, and DeFi can provide what its good at: a broader set of products and services for users.

Interestingly, Coinbase took a step in this direction in September 2019 when it provided $1M of USDC liquidity to both Compound and dYdX, two DeFi lending protocols. While the motivation behind the investment was to bootstrap adoption of USDC and protocol liquidity, it is nonetheless an example of what exchanges could and should do more of.

Step 1..User. Step 2…Owner

Longer term, the opportunity isn’t simply to be a user or liquidity provider to these protocols, but an owner. Just like financial infrastructure today is owned by the largest financial institutions, DeFi protocols (via their governance tokens) should be owned by stakeholders with the most to gain and lose from their success and failure.

Being an owner implies owning the underlying governance token, and would require an exchange to make a significant capital investment to acquire a token position capable of having a meaningful impact on governance. However, I have to imagine there is a model where the exchange becomes the proxy for individual users.

The Threat

The Internet democratized content publishing and consumption by commoditizing distribution. Pre Internet, content distribution required massive physical infrastructure in the form of newspaper delivery trucks, movie theaters and record stores, and this infrastructure was an enormous competitive advantage for the incumbent players. When the Internet arrived, it leveled the playing field, turning distribution from a competitive advantage into a public utility. Content publishers had no choice but to compete on other areas of the value chain.

The same spirit applies to DeFi. Embedding finance capabilities into the fabric of the Internet levels the playing field and lowers the barrier to entry. Aspects of financial services that were a competitive differentiator pre-DeFi will be table stakes. This forces every incumbent institution, including exchanges, to find other aspects of the value chain to compete on.

DeFi Aggregators

The DeFi ecosystem also has its own class of aggregators providing a consolidated user experience across dozens of Dapps. Instadapp, Zapper and Zerion simplify the DeFi experience, providing a dashboard-style UI enabling users to swap tokens, lend and borrow, and contribute to liquidity pools. Where exchanges are aggregating users and liquidity, DeFi aggregators aggregate products and services.

While these aggregators are non-custodial and not currently subject to regulation (could change in the future), the threat to exchanges is they raise money, get the proper regulatory approvals, and leapfrog. Blockfi did this with lending, so it can happen.

Parting Thoughts

Go Chiefs!

Thanks for reading.

Andy

Not a subscriber yet? Sign up here! Be on the lookout for next week’s issue, where I explore where DeFi fits in the broader context of the Internet and financial services.