If you’ve ever posted a photo on Instagram or uploaded a video on Youtube, you are a participant in the creator economy.

Large platforms like Youtube, Instagram and TikTok have built businesses around user-generated content. They own the supply (content) and demand (users), and help creators distribute content to an audience.

For reasons we will discuss, these platforms don’t actually sell any content. They give away the content for free in an effort to attract as many users to the platform as possible. When their user bases are large enough, they sell the only scarce resource they have…our attention, in one second increments to advertisers.

Platforms and “attention monetization” have defined the first phase of the creator economy, but blockchains, NFTs and Web 3 are ushering in a new era with new rules and opportunities for creators. This is our topic for the week.

Let’s zoom in…

Creator Economy 1.0

Today’s creator economy started with blog platforms. In 1998, Open Diary launched allowing users to publish blog posts and readers to leave comments. Since then, we’ve seen a wave of platforms focus on all types of content. Facebook and Youtube in 2005, Twitter in 2006, Instagram in 2010, Twitch in 2011, TikTok in 2016, and Substack in 2017.

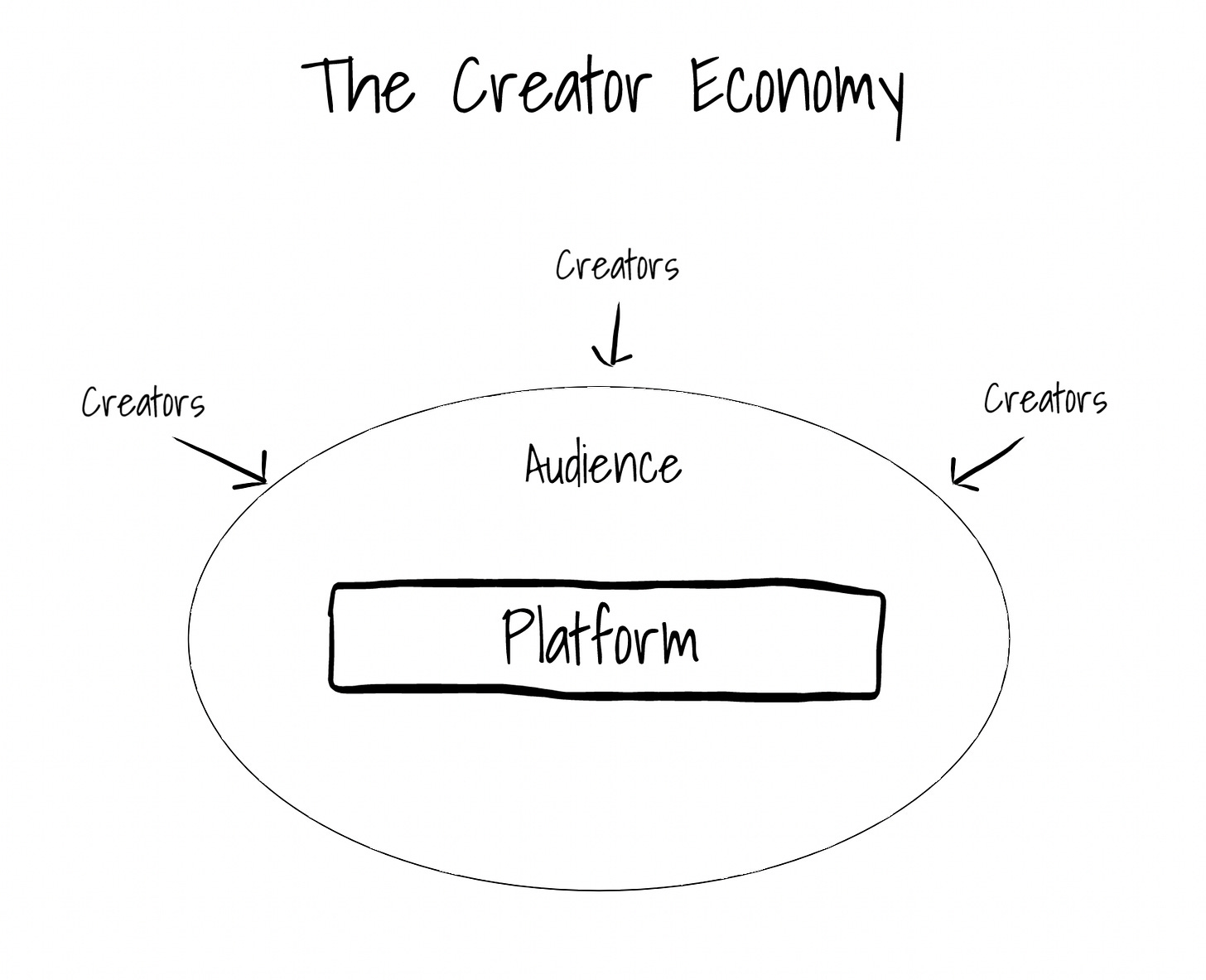

When you read these names, an obvious theme emerges. The creator economy is tethered to “the platform”. These platforms offer one primary value add to creators - distribution. Where else can a Youtuber get access to millions of potential viewers?

Platforms are uniquely positioned to provide distribution and reputation as a service because they maintain large user bases. Youtube has over 2.3 billion users access the the platform each month. Instagram has over 500 million daily active users.

This creates network effect. The more content they aggregate, the more users they attract. The more users they attract, the more creators and content they attract. It’s a recipe for explosive growth and stickiness.

Despite being content platforms, they don’t actually monetize their content directly. In the current business model, the asset is us! Content is free. The commodity is our attention, and these platforms sell it to advertisers in one second increments.

So while we say influencers are monetizing their content, what they are really doing is monetizing the seconds of attention their content attracts.

Another characteristic of a platform centric creator economy is the reputation creators generate (through followers and subscribers) is platform specific. You can’t take your fans with you. I like to say that these platforms actually own your reputation, and they let you use it rent free while you’re there.

Today’s creator economy is defined by the following:

Platform controlled. Large media platforms own the supply and demand. If you want to participate in either bucket, you need to be a user of the platform.

Ad-based business models. Platforms aren’t monetizing your content directly. Instead, they are selling your attention to advertisers. The more attention they aggregate, the more revenue they generate.

Platform-specific reputation. The followers, subscribers and fans creators attract on the platform are specific to the platform. If you want to transition to a different platform, you can’t take them with you. In some cases, you don’t actually know who they are.

Changing the Game

The rules of the game change when you add blockchains and tokens to the mix.

Ownership

Before blockchains, the value of content was that it could be consumed. You can read it, watch it, see it, listen to it. Each form of interaction requires our attention, and it is no surprise that attention and advertisement is what many creator economy business models are built around.

Enter blockchains. Blockchains do two things uniquely well - they control the total supply of something digital, and keep track of who owns what. These capabilities enable the creation of scarce digital things (NFTs), turning content into assets.

Assets can be owned.

This gives people an additional avenue for interacting with a piece of content - ownership. Not only can you read, see, watch and listen to it, you can own it.

Monetizing Content

The ability to own content creates an opportunity for platforms and creators to monetize the content directly, not just the attention it attracts.

Creators selling NFTs is the best example of this new business model in action. Not only can a creator upload a video to Youtube, capturing attention and earning reputation, they can also sell the video’s NFT to one of their fans.

This new dimension to the creator economy may have an impact on the value proposition of platforms.

Quality over Quantity

If you are starting a Youtube channel today, the advice you’ll get from successful Youtubers is to “be consistent” and “stick with it”. You don’t have to make incredible content every day, you just need to make content, consistently.

This “quantity over quality” dynamic exists because as a Youtuber, you aren’t selling each individual video. Your video is free! You are trying to attract the attention of viewers so they like your video and subscribe to your channel. The game you are playing rewards you for consistently delivering content.

Now consider a painter. She paints one beautiful portrait and sells it for $10,000 to one of her 50 passionate fans. She is a content creator just like the Youtuber, but she is selling her content, and the game she is playing rewards her for quality.

The difference is the painter is selling an asset, and the Youtuber isn’t selling anything.

Because blockchains turn content into assets, content creators can operate more like painters. Each piece of content is an asset that can be bought and sold, prioritizing quality over quantity.

Reputation

In the creator economy, reputation is measured by the size of your audience (followers, subscribers). As we covered above, one of the challenges with online reputations today is platform lock-in. Your 10,000 subscribers on Youtuve aren’t easily portable to Substack, for example. In some cases, you may not even know who your fans are.

Crypto and NFTs enable new models for building and managing reputation.

Imagine you are a writer that has sold your content in the form of NFTs to thousands of different people over the last 10 years. Because wallet contents are public, you know which wallets hold your NFTs. These are people who value your content enough to not just read it, but own it. Being able to take a snapshot of your audience at any point in time is a powerful tool for creators.

Social tokens are another trend. Imagine the same writer that sold NFTs also has a branded coin - WRITE - distributed to anyone that engages with the writer’s social media posts (liked, retweeted). Now the writer knows which wallet addresses have had positive interactions with his content.

Assuming the writer’s popularity continues to grow, WRITE holders also stand to benefit financially. They are now invested in the writer’s success, and are incentivized to continue supporting and evangelizing.

Across NFTs and WRITE, the writer has visibility and control over the audience, and an ability to incentivize them. The kicker here is it exists outside of a platform. This transfers enormous power back to the creator.

Assets = Marketplaces

The marketplace model has been so successful online because the Internet makes it very cost effective and efficient to bring supply and demand together on a single platform. Online marketplaces are also naturally larger than their physical world equivalents (i.e. farmers markets) because they aren’t constrained by geography and physical space.

For a marketplace to emerge, you need: a variety of things in scarce supply (it can’t just be one thing), and a variety of demand.

Now that content is an asset, marketplace models have emerged around content ownership. These marketplaces allow creators to sell directly to buyers, but probably more lucrative is the secondary market they support. OpenSea, the largest NFT marketplace, is now valued at over $1B.

What I’m curious about, but haven’t figured out, is whether digital content has a similar shelf life as physical products. For example, the value and utility of a computer decreases every year as it ages and more powerful computers are released. Digital content doesn’t experience the same wear and tear as physical things, but it still ages in the sense that there will always be new, more relevant content to compete with.

My guess is the vast majority of digital content will have a relatively short shelf life. Only the most unique or highest quality content will hold any meaningful value long term, like an antique. Interesting to think about…

The Ownership Economy

When I realized every physical asset, every financial asset, and every piece of online content will eventually be represented by a token, I also quickly realized that we are going to own A LOT of digital stuff.

As a species, we love to collect things. Whether it’s baseball cards, art, money or social connections. We love to amass stuff. It makes us feel safe, and it’s also a sign of status. A form of social credit.

Just like user generated content platforms led to the creator economy, digital content ownership will lead to the ownership economy. We are going to own thousands of things - all represented by a token and managed in our wallets. I’ll admit I haven’t explored all the ramifications of this, but it will absolutely be a topic of a future issue.

Parting Thoughts

Consumption of digital content isn’t going away. In fact, that market will continue to grow. But blockchains and NFTs are adding a new dimension to the creator economy.

This dimension is based on ownership. If you create it, you will own it, and have the ability to monetize it.

Attention (Creator Economy 1.0) and ownership (Creator Economy 2.0) models will live in parallel, they won’t be mutually exclusive. They will merge, and create new opportunities for platforms and creators.

Thanks for reading,

Andy

--

Not a subscriber? Sign up below to receive a new issue every Sunday.

But what do NFTs and blockchain add to the situation?

I am in a rare, perhaps unique, position to ask this question, as not only a veteran professional writer and seriously involved in crypto, but as well the longtime host of the oldest digital writers discussion on the planet, the Writers Conference on The Well, in continuous discussion since 1985. The members of our group have been continually talking about and engaging in all of the new methods of distribution and "monetization" that have arisen during those decades. Musicians, poets, novelists, non-fiction writers, comic writers, game creators, they have used everything from the big platforms you mentioned to things like Patreon, SquareSpace, Zoom, and Facebook Live events. They have used all these platforms to generate reputation, organize events, directly make money, sell products, and connect with fans. They already generate digital and physical assets their fans can own (books, CDs), that the creators still own rights to, as well as multiple revenue streams based on content they give away for free.

Because of my involvement in crypto, I have been eager to explain to this small but intense group of serious professional writers how NFTs can add to their tool chests for bringing their content to the public, creating a fan base, and making money from that. I have not done that, because I so far have not figured out what NFTs add, what they either make easier, more possible, or more remunerative than the methods we already have.