I started writing this issue a few months ago but set it aside. At the time, I didn’t have enough of a point of view to add something unique to the DAO conversation.

Fast forward a few months, and DAO Summer is in full swing. I can’t hold off any longer.

The concept of a DAO (decentralized autonomous organization) has actually been around since 2013, but it has become THE topic in crypto over the last 6 months.

Why?

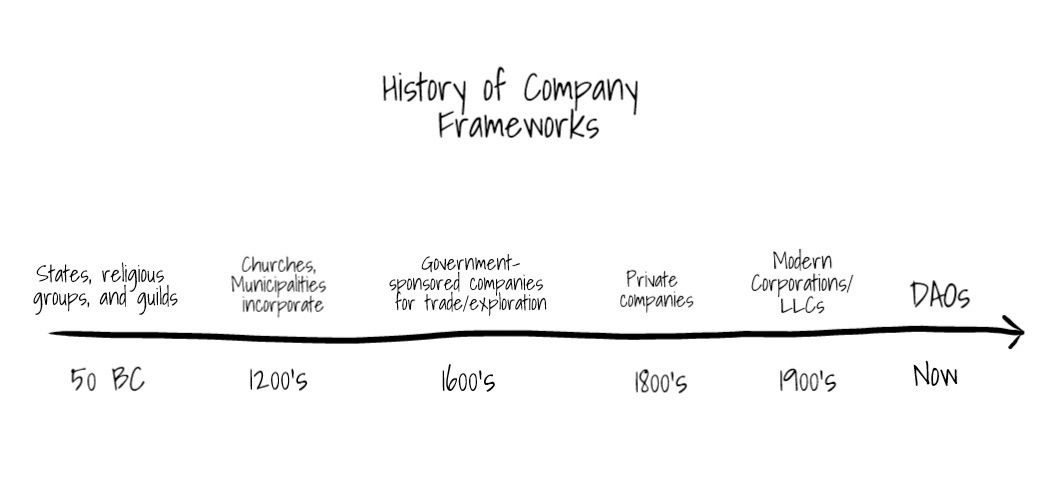

A few reasons, which we’ll get into. But before we do, it is important to understand that DAOs are the just the most recent framework for a group of people to organize around a particular purpose. Humans have been doing this for thousands of years.

Let’s dive in…

The Corporate Form

To really appreciate the purpose DAOs serve, it’s helpful to understand the history of more well known corporate structures. I promise not to bore you with an extended discussion of the history of the company. We’ll do this in less than 60 seconds.

Companies, in one form or another, have been around since Ancient Rome. Back then, the Senate or Emperor would approve the creation of legal bodies for different things - municipalities, political groups, social clubs, and guilds of craftsman or traders. They had the right to own property and could enter into legal contracts. These were communities, comprised of people with similar beliefs or skills.

The concept of a corporation was revived in the Middle ages as churches and local governments became incorporated. But there weren’t many examples outside of government and religion.

By the 17th century, governments were forming companies for exploration and trade. One of the most well-known companies of all time, the Dutch East India Company, was operating under a charter from the Dutch government, with the exclusive right to trade with the East. So much for a free market! The Dutch East India Company was a government-sponsored monopoly. Interesting fact, the Dutch East India Company was the first formally listed public company in the world when it started selling shares to the general public in the early 1600s.

In the centuries that followed, private companies become popular. Today, corporations, limited liability companies and partnerships are the primary structures of modern business.

Whether it was a Roman guild, a medieval church, a government-sponsored trading company or a tech startup, the purpose of a company (outside of the modern concept of limited liability) is two fold:

Ensure the business can outlive any single person, and

Direct capital and labor toward a task that requires more than one person

In other words, it’s a framework for organizing capital and labor that can exist in perpetuity.

DAOs

Software and the Internet have created new rules for human labor and coordination. Software is slowly eating entire industries, automating tasks that previously required armies of people, and the Internet has enabled new forms of coordination (via virtual communication).

These technological advances have led to the rise of decentralized systems like blockchains and DeFi protocols - the poster children for software and the Internet’s impact on labor and coordination.

The crypto industry finds itself in a situation where there are just as many decentralized systems operating as there are traditional companies. Sticking with our theme that companies direct capital and coordinate labor toward a specific task, the question becomes how do we direct capital and labor efficiently for decentralized systems?

The answer…DAOs.

The concept of a decentralized autonomous organization actually didn’t begin with Ethereum. A DAO was first proposed by Daniel and Stan Larimer, founders of BitShares (Daniel later founded EOS). If you were around in 2013 and 2014, you may remember Daniel Larimer and Vitalik Buterin (creator of Ethereum) as the two most forward thinking minds in the industry, and they would occasionally engage in head-to-head debates at conferences.

In 2013, the Larimer’s authored several articles describing something they called a “decentralized autonomous company”, or DAC. DAC’s had all the spirit of a DAO, but they were missing smart contracts, which wouldn’t show up until 2015 with Ethereum.

So what is a DAO?

In the most practical sense, a DAO is a combination of two parts:

One or more smart contracts that (a) hold capital (treasury), and (b) enforce a decision making process (example - before capital can be spent, a majority of token holders need to vote “yes”), and

A token, representing ownership in the DAO and the ability to participate in the decision making process (voting).

These components - capital, ownership and a decision making structure - are the minimum viable components of a company too.

Example - Venture Fund

If you’re still confused, let’s look at a business model that exists in both the traditional form and a DAO today.

A typical venture fund exists as a partnership. There are two types of partners, limited and general. Limited partners (aka investors in the fund) contribute capital, and general partners (aka VCs) make investment decisions and manage the fund. The mechanics of the partnership are managed by a partnership agreement, and the partners are expected to follow those mechanics.

Now let’s assume a loose collection of people around the world want to pool their capital and invest together? They could form a limited partnership, sure…but that would require choosing a jurisdiction, negotiating a partnership agreement, and an enormous amount of trust that the people involved will act in the best interest of the group. That’s a lot of cost, time and risk.

Or they could form a DAO.

The partnership agreement and bank account get replaced by a smart contract. The ownership interest in the partnership get replaced by tokens. General partners get replaced by token holders.

Here’s a visual…

What is fueling DAO growth?

I like to think about why things become popular.

In tech, when something pops it’s usually because several independent forces in the market converge at the right time. For ICOs in 2017, it was the combination of Ethereum and smart contracts, the ERC20 token standard, and an explosion of trading platforms for retail investors. For NFTs in 2021, it was the combination of the ERC721 token standard, the pandemic forcing creators to find new ways to monetize their work, and online platforms that support the creation and trading of NFTs.

For DAOs, it is:

Clear need in the market. A few years ago there were a handful of DeFi protocols. Today, there are 100+, and they need to be managed like any other business.

Standards. There are widely adopted frameworks from projects like Aragon that make creating DAOs simple. The technical barrier to entry is being lowered.

Improved user experience. As recently as 2020, participating in DAOs was not easy or enjoyable. The user experience was awful. It was hard to coordinate and vote. Today, the tools are significantly better and improving every day.

The Future - DAOs for Literally Everything

We are entering a world where these Internet-native companies will be everywhere, for everything.

There are protocol DAOs that manage DeFi protocols like Maker, Uniswap, Compound, Aave and Instadapp.

There are investment DAOs, like our example above, that invest capital in other projects or assets.

There are service DAOs that provide specific services, like treasury management, to other DAOs (shoutout Llama DAO)

Here’s a great graphic from @coopahtroopa showing a pretty comprehensive view of the DAO ecosystem today.

In the not too distant future, expect college graduates to choose a job with a DAO over a company. Expect kids to participate in DAOs before they graduate middle school.

My not so bold prediction - the largest DAOs will have millions of participants. They will wield enormous influence, and politicians will court DAO support the same way they court big company, union and industry support today.

Parting Thoughts

If you’re interested in learning about the issues facing DAOs from some of the brightest minds in the industry, the DAO Summit will be held this upcoming Wednesday, hosted by the DAO Research Collective and the Stanford Center for Blockchain Research. I highly recommend attending…and it’s free!

Thanks for reading,

Andy

--

Not a subscriber? Sign up below to receive a new issue every Sunday.

I love to think about the chaos this is going to cause within the traditional corporate structure. Today we pay the CxO huge sums of money to make the right decisions on befall of the organization; tomorrow that risk will be diversified. To me DAOs are all about a streamlined way of making the right decision more often and collectively sharing in the results of those decisions (positive on negative).

This is a great and quick synopsis. I think I recall that you are a lawyer by trade. How feasible do you think DAO's will be in the near term for syndicated real estate investment? Is there a place for DAO's to own physical assets?