Issue #2: The Brand Strategy of Exchanges

Last fall, I took an online brand strategy course by NYU marketing professor Scott Galloway. Scott is a marketing savant and has had a successful business career, founding several consulting firms and serving on the boards of Gateway Computers, Eddie Bauer and The New York Times. He also writes one of the few newsletters I read religiously, No Mercy / No Malice. I highly recommend it.

I learned a lot from Scott and thought it would be fun to use a framework from the course to assess the brand strategy of the largest cryptocurrency exchanges.

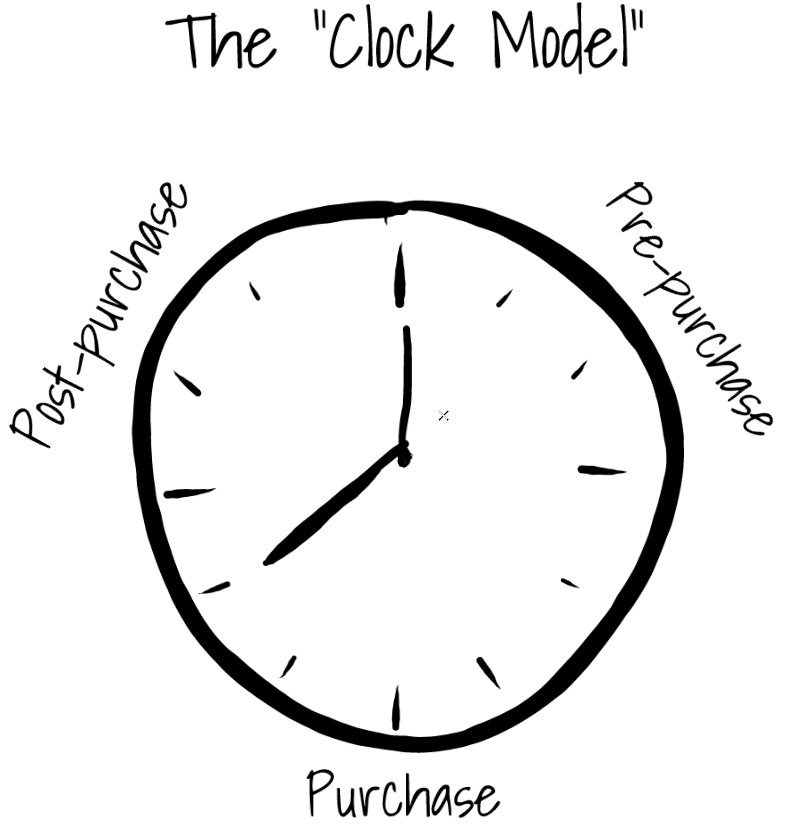

The Clock Model

The “Clock Model” uses a 12-hour clock as a metaphor for the customer interaction lifecycle. The lifecycle is broken down into three phases: Pre-Purchase (12-4), Purchase (4-8), and Post-Purchase (8-12). Every interaction between a brand and its customer falls into one of these phases.

· Pre-purchase is about generating awareness and intent. This is usually accomplished through advertising, but also includes PR, social media and sponsorships.

· Purchase is about the touch points with the customer during the purchase experience. This is the physical store, the website…all the points of contact involved in making the purchase.

· Post-purchase is about maintaining the customer relationship after the initial purchase. Examples of post-purchase include customer support, loyalty programs and warranties.

Brands can usually differentiate themselves from competition by making outsized investments in one phase of the customer interaction. Nike has historically made outsized investments in Pre-purchase, producing iconic commercials and endorsing the best athletes across the sports spectrum.

A few companies do all three extremely well. Apple is one of them. They created awareness and intent with great advertisements for the iPod and iPhone. Apple also made outsized investments in the Purchase phase when they launched the Apple stores. And their related launch of the in-store Genius Bar was a huge investment in post-purchase. The trifecta!

Let’s apply the framework to cryptocurrency exchanges…

First up…Coinbase

Coinbase is arguably the most recognizable brand in the industry. They have been around since 2012, and are the closest thing we have to a household name.

Coinbase has historically made an outsized bet on Purchase, prioritizing product and building the best trading experience, especially on mobile.

However, after Coinbase acquired Earn.com in 2018, they made education a focus. Users could earn small amounts of cryptocurrency by completing mini education courses about the project. This was a unique investment in Pre-purchase. Coinbase was betting that if users had more awareness and a better understanding of the different assets available on the platform, they would be more inclined to buy. And they were right! Coinbase Earn has educated approximately 1 million unique users across 115 countries. And many users who completed an Earn education campaign purchased more of the cryptocurrency they learned about.

In the words of Scott Galloway, this was a “gangster move” by Coinbase. Educating your users isn’t sexy, but Coinbase proved it can be a differentiator.

It also says something about one of Coinbase’s target markets - newcomers. “New to crypto? We’ll get you up to speed”. That’s a powerful position to occupy in the market.

Gemini

Gemini also has a track record of making outsized bets on Pre-purchase. There has long been the perception that crypto is the “wild west” and exchanges serving the market are light on compliance (not true in many cases). In an effort to differentiate itself early on, the company wrapped advertisements on city cabs and buses in downtown New York City and San Francisco marketing Gemini as “the regulated cryptocurrency exchange”. And they put their money where their mouth was. Gemini went to great lengths to satisfy state and federal regulations in the US.

This strategy tells you a lot about one of Gemini’s target markets - investors who value reputation and compliance.

Gemini’s commitment to compliance and “doing it the right way” continues today. They announced earlier this month that they were the first exchange to receive Type II SOC reports (third party reports covering the effectiveness of a company’s internal controls over a period of time) for both their exchange and custody services. This is another attempt at differentiation geared towards a sophisticated, more risk averse customer that values operational excellence.

Gemini’s strategy has been consistent since it launched in 2014, and their brand is now synonymous with compliance.

Kraken

Kraken was one of the earliest exchanges, and has maintained a “maverick” reputation - great at what it does, but playing by it’s own rules.

Interestingly, Kraken makes outsized investments in Post-purchase, consistently prioritized customer support. Kraken employs a small army of customer support staff around the world serving both retail and professional traders. This brand strategy isn’t only represented by headcount. Kraken is the only exchange I’m aware of that offers 24/7 chat support. They even include the customer support contact in their Twitter account bio!

Despite the maverick persona, Kraken has consistently gone out of its way to be accommodating to users. “Contact us! We want to help”. They are attracting a user that values service and a personal touch.

This outsized focus on Post-purchase is a clear differentiator.

Binance

Binance launched in 2017 and enjoyed immediate success by making an outsized bet in Purchase. Their strategy was simple - selection. Give users access to more assets than any other exchange.

Binance wasn’t the first exchange to take this approach either. Poloniex and Bittrex beat them to it by years. But in the end, Binance was the best. It found a lane that was being underserved and excelled where its competitors struggled.

The strategy gives you insight into one of their target markets - retail investors looking for “the next big thing”.

More interesting though, is Binance’s unique bet on Post-purchase. The company has consistently focused on building a sense of community around the Binance brand. This has come in the form of swag and car giveaways, user competitions of all varieties (coding, music, video), and probably most impactful, the creation of BNB token, which among other things gave holders the ability to vote for tokens they wanted to see listed on the exchange.

Binance is really, really good at user engagement, and they have a loyal community to show for it.

Community is the most underappreciated aspect of Binance’s brand strategy.

Applying the “Clock Model”

Whether you are an executive at a crypto exchange or a strategy associate at a consumer products company, the Clock Model is an easy framework that can help you assess where to allocate capital and resources to differentiate your product or service in the market.

Thanks for reading,

Andy

Not a subscriber yet? Sign up here!