Before we jump in, I want to draw attention to the COVID crisis in India and the crypto community’s fundraising efforts to help. Every day for the last week, India has set single day records for positive cases and deaths and their healthcare system is buckling under the weight of patient demand and a lack of resources.

In response, @sandeepnailwal from Polygon created the India Crypto Relief Fund (@CryptoRelief_) and is collecting donations in crypto, converting to fiat and distributing locally to organizations on the ground. Over $5M has been raised in the last 2 weeks (including over $3M from Vitalik), and real-time transparency reports are available on the website.

I haven’t used my platform like this before, but I can’t think of a more deserving cause to promote. Crypto is one big family, and Indian and Indian-American entrepreneurs have had an immeasurable impact on this industry. I encourage everyone reading to contribute an amount you are comfortable with.

Donation addresses for ETH, BTC and a dozen other cryptocurrencies are available here: CryptoRelief.in/donate. If you donate, email me the transaction ID (link to Etherscan or equivalent) and I will match up to $5,000. ____________________________________________________________________________

This week’s topic is new for 30,000 Feet, but one I’ve been interested in for a while. NFTs, or non-fungible tokens, have found their way into mainstream pop culture recently as artists, musicians and media companies have leveraged the technology to monetize IP and re-engage with fans after an involuntary 12-month hiatus from live and group events.

As someone who majored in music business in college, I’m thrilled to see a musician’s ability to monetize their work untether from the traditional record label/live performance model.

As someone who also went to law school, I’m keenly interested in the rights associated with NFTs. Some of the most popular NFTs are selling for millions of dollars, but what are buyers actually getting? Do they know?

All that and more in today’s issue. Let’s zoom in…

A Refresher

Fungibility…which is not a word most of us learned in school, is usually associated with things like currencies, where each dollar is mutually interchangeable with another dollar. For this reason, we say dollars are fungible (pronounced fun-jibble). Cryptocurrencies like Bitcoin and Ethereum are fungible too. One bitcoin is identical to another bitcoin.

Something that is non-fungible implies it is…not…mutually interchangeable. Instead, it is unique, or one-of-a-kind.

While fungible tokens are the vehicles for representing cryptocurrencies on blockchains, non-fungible tokens are the vehicles for representing unique, one-of-a-kind things. Think art, collectibles, intellectual property, real estate, credentials and identity. Anything with a population of 1.

The first mainstream example of NFTs was Cryptokitties in 2017. Cryptokitties are virtual cats, each one unique and memorialized with a token on the Ethereum blockchain. You can resell them, breed them, dress them up, even race them.

If 1 million cats were created, there are 1 million non-fungible tokens on the blockchain.

But practically, what is it?

Popping the hood on popular NFTs like Cryptokitties, NBA Top Shot or the Beeple compilation art piece that sold for $69M will reveal the same two components: (1) a blockchain token, and (2) the media associated with the token (image, audio, video) that lives outside the blockchain (“off-chain”).

The token is unique and native to the blockchain, equivalent to a digital certificate of ownership. The media is the visual representation of whatever the thing is. In the case of Cryptokitties, the image of the cat. In the case of NBA Top Shot, the official NBA video footage of players’ highlights.

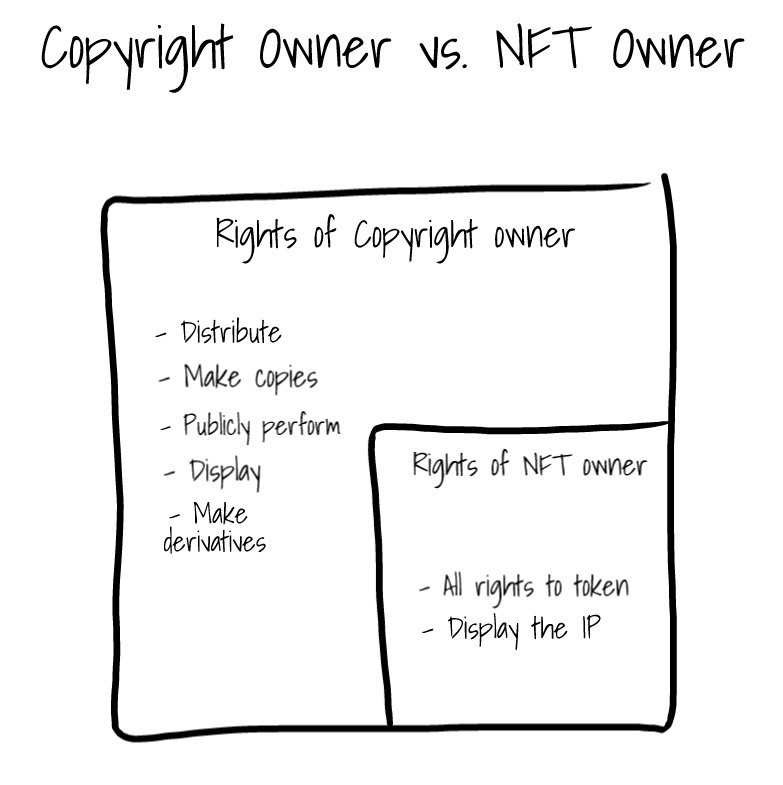

So what rights do you get?

Sticking with digital cats for a second, the rights you have as an owner of a cryptokitty are component-specific.

As it relates to the unique blockchain token, you have full ownership rights, including the ability to resell. These are the same rights you have to a piece of physical art you bought from a gallery, or a baseball card you’ve had since you were a kid.

As for the image of the cat, the owner only acquires the following rights under a license:

Use of the image for your own personal, non-commercial use;

Use of the image when you’re on a marketplace that allows the purchase and sale of your NFT

Use of the image when you’re on a third-party website or app that allows the inclusion, involvement, or participation of your NFT, and

Use of the image to commercialize your own merchandise, provided that you aren’t earning more than $100,000 in revenue each year from doing so.

So while you own the token outright, you can only use the image to “show it off” (the equivalent of hanging art on your wall), and put it on sweatshirts and coffee mugs as long as you don’t make more than $100k/year.

So why the restrictions?

A little something called copyright.

Copyright

Copyright protects the expression of an idea. In the case of Cryptokitties, the expression is the image of the cat.

The moment the cat image was created, Dapper Labs (creator of Cryptokitties) become the copyright owner and has the right to decide how the image can be used.

Dapper owned the copyright to every cryptokitty image and they still do! Remember, when you buy a Cryptokitty, either from Dapper or on a secondary market like OpenSea, you only receive the token and the four specific rights granted to you under the license. Dapper keeps the rest.

What about the musicians who sold NFTs?

Samesies.

Kings of Leon, 3LAU, and Grimes all sold NFTs in the last three months, and not one of them included the copyright to the underlying intellectual property. And you can understand why. Selling the copyright would mean forfeiting all future revenues generated by the IP.

When Kings of Leon sold a limited number of unreleased songs, the token essentially served as a key, redeemable for a single download.

They also included collectible album artwork with the purchase of their NFT. Buyers received a license almost identical to the one used for Cryptokitties:

“[Kings of Leon] grants you a worldwide, non-exclusive, non-transferable, royalty-free license to use, copy, and display the Art for your Purchased NFTs and any Included Merchandise, solely for the following purposes:

for your own personal, non-commercial use;

as part of a marketplace that permits the purchase and sale of your NFTs

as part of a third party website or application that permits the inclusion, involvement, or participation of your NFTs”

Memes

I can’t write a crypto newsletter issue about NFTs and not mention memes…

The NFT of the famous “Disaster Girl” photo-turned-meme from 2005 (shown below) recently fetched over $500,000 at auction. What exactly did the buyer get?

The photo was taken by the girl’s father, so he owns the copyright to the image.

The meme was sold on Foundation.app, and their Terms of Service expressly state the buyer does not receive any intellectual property rights except those contained in the language below…

“Collectors receive a cryptographic token representing the Creator’s Digital Artwork as a piece of property, but do not own the creative work itself. Collectors may display and share the Digital Artwork, but Collectors do not have any legal ownership, right, or title to any copyrights, trademarks, or other intellectual property rights to the Digital Artwork, excepting the limited license to the Digital Artwork granted by these Terms. Upon collecting a Digital Artwork, Collectors receive a limited, worldwide, non-assignable, non-sublicensable, royalty-free license to display the Digital Artwork legally owned and properly obtained by the Collector.

Collectors have the right to sell, trade, transfer, or use their Digital Artwork, but Collectors may not make “commercial use” of the Digital Artwork.

Again, essentially the same set of rights we see with Cryptokitties and Art/Music NFTs. The copyright, predictably, remains with the girl and her father.

Still a Big F*ing Deal

The reality is, the rights associated with NFTs are the same rights associated with a piece of physical art. You acquire the property rights to the specific thing, but you don’t own the IP itself. This is the dynamic that allows you to own the original painting, but for the artist to continue selling prints for a fraction of the price. She owns the right to monetize the idea, and you own the right to a specific expression of that idea - the original work.

If you’re wondering just how innovative NFTs are, the answer is really innovative. But, it has nothing to do with the rights associated with them. Instead, it has to do with the fact that for the first time ever we have the ability to create truly unique, digital things.

Parting Thoughts

The business models around NFTs today are rudimentary, but they will evolve quickly. There are already a few examples of musicians using NFTs to tokenize and fractionalize the copyright to a song, allowing fans to buy a percentage and have a real ownership stake in the song’s success.

This is the future of fundraising, and it is also the future of investing.

Thanks for reading,

Andy

--

Not a subscriber? Sign up below to receive a new issue every Sunday.

Excellent article Andrew. Can I get an NFT token for this article? :)