When I joined EY’s Blockchain Team in 2016, we had a saying that “everything that can be tokenized, will be tokenized”. If you zoom in closely on my Linkedin profile picture, it’s also the phrase that appears on the powerpoint slide behind me.

It was a catchy “bumpersticker phrase” that represented our belief that everything would be tokenized on blockchains one day. I had a strong conviction about this, but the “why” wasn’t something I could clearly articulate back then. What is the benefit of tokenizing something?

We’re going to unpack that in this issue, but here’s the 30,000 foot view…

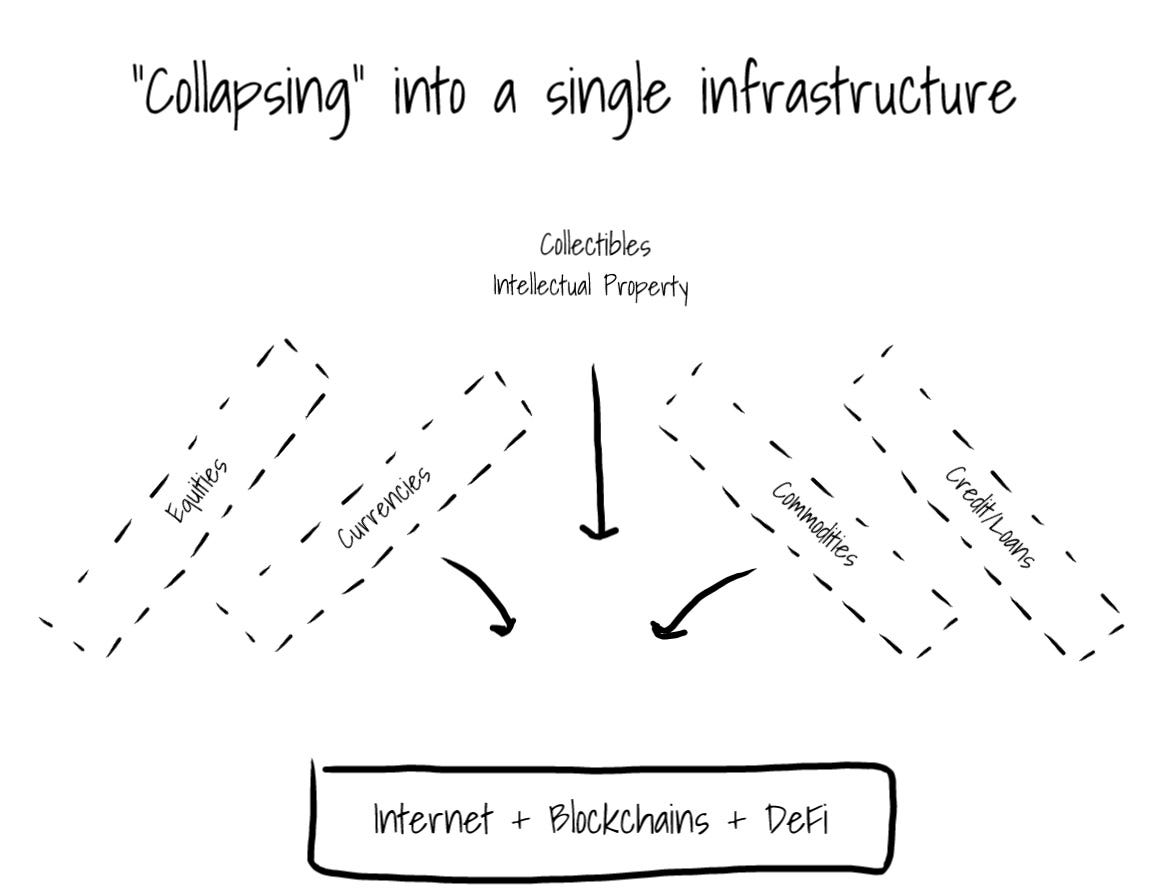

The Internet + Blockchains + DeFi collapse dozens of asset-specific financial market infrastructures into a single technology stack, and the rules of that stack require assets to exist as tokens. Therefore, everything that can be tokenized, will be tokenized, if it wants to leverage this infrastructure.

Let’s zoom in…

Asset-specific Infrastructure, or None

In our financial markets today, the large asset classes have their own market and technology infrastructure:

US Dollars are issued by the Federal Reserve and from a payment standpoint move around on rails like the Automated Clearing House (ACH), Fedwire, and card networks (Visa, Mastercard, Discover, American Express). All of these payment rails have their own infrastructure, and charge their own fees.

Foreign exchange (FX) is managed by a global network of banks and other organizations, while the underlying supply of each currency is managed by the respective country’s central bank.

Public equities (e.g. company stock) are centrally managed, cleared and settled by the Depository Trust and Clearing & Clearing Corporation (DTCC) at the highest level, and a series of banks and broker dealers at the end investor level.

Commodities like gold, oil and energy are traded on commodities exchanges. The majority of commodities trading occurs in the form of futures contracts, which are also managed by the exchanges.

Mortgages, credit cards, small business loans and other types of consumer and business financing arrangements are managed on the books of the financial institutions providing them.

There are also a lot of other assets, like collectibles and intellectual property, that historically haven’t had any infrastructure to support them.

So here’s the landscape:

Asset-agnostic Infrastructure

I’ve described blockchains, token standards and DeFi collectively as “Internet-native financial infrastructure”, and it is mostly certainly that. But, it is also fair to describe it as asset-agnostic financial infrastructure.

Think about that. A single financial infrastructure for any asset!?

As I discussed above, US Dollars and shares of publicly traded stock exist and move on two completely different technology stacks, and other asset classes don’t have any infrastructure supporting them at all.

Now, we have transformed the Internet into financial infrastructure that can simultaneously support cryptocurrencies, stablecoins, NFTs, tokenized public company stock, commodities, and dozens of other assets.

This new infrastructure doesn’t natively support every asset. It supports tokenized assets. Once an asset exists as an ERC20 token for example (the Ethereum token standard for fungible assets), the asset has access to the infrastructure and financial markets built on the Ethereum blockchain. It doesn’t matter whether the token is a cryptocurrency, or represents a bar of gold or one US dollar. (Side note - this is why token standards are such an important element of blockchain infrastructure. They make it incredibly easy to tokenize a new or existing asset, and ensure that the asset can be supported).

To summarize, the impact of blockchain-based financial infrastructure (public blockchains, token standards and DeFi protocols + user facing tools like wallets) is two fold:

(1) Existing, mature financial infrastructure (ex: for US Dollars and publicly traded stocks) is collapsing into public blockchain infrastructure

(2) Any asset class can leverage this new infrastructure, as long as it is in tokenized form.

If it sounds far-fetched, it isn’t. The Internet commoditized content distribution by collapsing the distribution infrastructure of newspapers and magazines (printing machines and trucks), books (physical books and bookstores), music (CDs, record stores, radio), tv and film (televisions, TV networks and movie theaters) into a single infrastructure…the Internet!

Gravitation Pull

Music distribution is a great analogy for crypto. If you are a musician today, there is a big incentive to distribute your music digitally. Distribution infrastructure, in the form of Spotify, iTunes, and other download and streaming platforms, exists to help artists distribute their music digitally. These platforms have aggregated all your listeners and potential listeners in one place. They’ve built a marketplace around supply and demand for music. Music = supply, and listeners = demand. These platforms have a gravitational pull on new music.

For an asset, particularly one with little or no financial market infrastructure today, there is a big incentive to tokenize on a public blockchain. It gets immediate access to a global financial infrastructure.

Not only does a tokenized asset get access to infrastructure, it also gets access to the ecosystem of products and services built on top of that infrastructure. Exchanges, custodians, lending platforms, wallets, derivatives, etc. It’s all there, as long as you are a token. Just like Spotify has a gravitational pull on new music, the financial system emerging on top of public blockchains (particularly Ethereum) has a gravitation pull on assets.

The Sequence

Not all assets will be tokenized and put on blockchains at the same time. There are a few factors that impact when an asset class is likely to be tokenized: switching cost, and regulation.

Assets with existing, mature financial infrastructure have a higher cost of switching to something new. A ton of time and money is locked up in the old system. Switching, even to something superior, is painful and expensive, and for something like publicly traded stock, requires a lot of industry coordination.

Switching cost is the reason why cryptocurrencies and NFTs make up almost 100% of the assets on public blockchains today. There is no switching cost for these assets because they are brand new.

Asset that are highly regulated tend to be those with existing mature infrastructure. The infrastructure is often built with regulatory compliance in mind. This makes existing infrastructure even stickier.

Here is a graph showing how different asset classes compare on these two factors. Asset towards the bottom left will have an easier time moving to blockchains. But eventually, they will all get there.

Switching cost is the reason why the US is ten years behind Southeast Asia and Australia in payments technology. We are burdened by an old system that still supports physical checks and swiping a plastic card. Everywhere else is “tap and go”.

It’s also the reason why parts of Africa were able to leapfrog dial up internet and land line telephones and go straight to smart phones and WiFi. They weren’t burdened by large, clunky existing physical infrastructure.

Parting Thoughts

I often hear blockchains compared to Visa or the DTCC from a transaction volume standpoint. But how we should really be thinking about them is in terms of Visa, Mastercard, Discover, American Express, DTCC, CME, NYSE, Nasdaq, Western Union and other infrastructure providers combined.

Two thoughts to close this out…

First, this is why scaling and Layer 2 solutions are so important. The industry is trying to build a single financial infrastructure for EVERYTHING, and that requires throughput equivalent to all the companies listed above and then some. It would be very challenging for a single ledger to keep track of every asset transaction on the planet.

Second, while I intentionally stay away from talking about specific assets or investments in this newsletter, we are watching public blockchains slowly absorb the assets, transactions, users and market capitalization of these asset-specific infrastructure providers. Public blockchain infrastructure collapses all of those separate pieces into one technology stack, and you can own a piece of that technology stack.

You couldn’t buy the Internet in 1995, but you can buy blockchains and DeFi protocols today. You can own the new global financial infrastructure.

Thanks for reading,

Andy

Are people on the list?

I agree w/ this view. This is why I find Liechtenstein’s regulatory approach which is based on the concept of the/a “Token Container” (a token can represent anything) so interesting and forward looking