Issue #10: Decision Making

Like many of you, I get asked for investment advice more often when the crypto markets are up. The questions are usually some combination of “what should I buy?”, “what projects are you excited about?” or “do you think the market will keep going up?”.

Rather than saying I don’t give investment advice, which just reinforces the cliché that lawyers speak in disclaimers, I respond with another question…

What is your strategy?

I know their goal is to make money, but I ask the question because their approach to making money can and usually does vary. For example, people day trading are taking advantage of daily movements up or down in the market. Whether they believe in the long-term success of the asset they are trading is irrelevant. They want volatility.

The day trader’s approach is very different from someone buying and holding for long term appreciation. For them, daily movements up or down are irrelevant, but they need to be confident in the long-term viability of the asset. Both groups have the same goal of making money, but the approaches, time horizons, and risk profiles are very different.

I don’t usually answer their original questions about what they should buy or when, but we always have a great conversation about their strategy. I like to think that advice is more helpful.

--

Conversations like the one above happen thousands of times a day across the industry. There is a growing number of digital assets available to investors, and a growing number of ways to put those assets to work. Investors are hungry for insights and advice, and there isn’t a great mechanism for providing this at scale.

For the time being, the onus is on the investor to navigate these decisions alone, but I think companies in this industry have a big opportunity to help.

Let’s zoom in…

(apologies in advance for the lack of pictures and diagrams 😊)

Evolving Needs

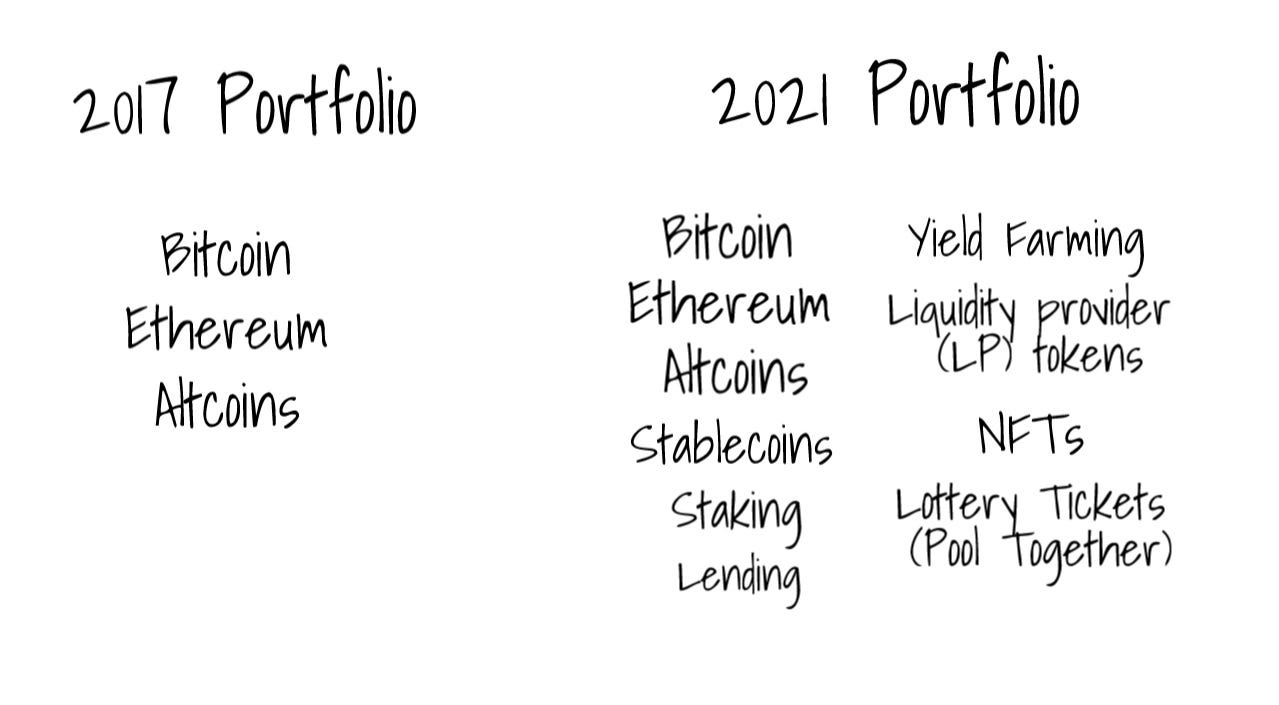

From 2009 – 2017, a person investing in crypto needed to answer one question – what am I buying? There were a few dozen cryptocurrencies available to most investors, so choices were limited.

Towards the end of that period, the number of cryptocurrencies exploded (due in large part to the ERC20 token standard making it really easy to create a new digital asset on Ethereum). But while the number of choices expanded, the underlying question for investors was the same.

What am I buying?

Then in 2017, a second question started becoming relevant - once I buy crypto, what should I do with it?

This coincided with the birth of two things that brought enormous utility value to crypto – lending platforms and DeFi. Where before, investors were limited to buying, selling, and holding digital assets, now they had the ability to lend their assets, borrow against them, and put them to work in the DeFi ecosystem. A new financial system was maturing in real time, and investor portfolios reflected these new opportunities.

A Maturing Financial Ecosystem

To me, the transition from what should I buy, to what should I do with the assets once I buy them, is a signal that the crypto economy is evolving. We finally have utility value!

This evolution really gets at the heart of what financial markets are all about – moving capital, assets and risk efficiently to people that value them the most. The largest financial institutions in the world have built business models around this.

For example – when I deposit money into my savings account, my bank immediately loans that money out in the form of credit cards, mortgages and small business loans to people and companies that need it and are willing to pay for the right to use it. That is a financial system operating efficiently.

The difference between the traditional financial system and the crypto economy is that people have more autonomy over how their assets are used in the crypto economy.

While I’ve been dismissive in the past of the crypto mantra of “being your own bank” (because I didn’t think most people want to, or should be), there is some truth to this statement. Blockchains, crypto and DeFi are shifting the ability to efficiently move capital, assets and risk from institutions to individuals.

This shift creates a lot of new business opportunities for forward-thinking platforms to help investors answer the question “what should I do with my assets”?

The Opportunity

I’m part of a growing group of investors that own digital assets, and want to put those assets to work, the same way a bank puts the money in my savings account to work today when I’m not using it.

However at the moment, the experience around deciding when and how to put my assets to work is akin to ordering off the menu at The Cheesecake Factory. There are just so many options. It’s overwhelming. And if you think I’m being hard on The Cheesecake Factory, keep in mind their menu is 21 pages, and features over 250 items. Pure insanity.

What I need is a platform that looks at my portfolio and says, “Ok, we see you own A, B, and C digital assets. Based on your goals and risk profile, you should consider lending out Asset A through this lending protocol, and contributing Asset B to the liquidity pool for this decentralized exchange. We also see you have contributed Asset C to a different liquidity pool, but you can actually make 25% more over the next year by transferring it to this one. Want to move it?”

One my favorite companies in DeFi, InstaDapp, has started scratching the service (disclosure, I am an advisor and investor). InstaDapp is a DeFi aggregator that helps you manage your assets and positions across multiple protocols. Put differently, they are a universal dashboard for DeFi. One of the features they experimented with early on was loan refinancing. If you had an outstanding loan on MakerDAO, InstaDapp would let you know if there was a lower interest rate available on Compound, and help you refinance. This “bridge” functionality between lending protocols found immediate product market fit in 2019 and has been used to refinance roughly $1B of DeFi loans over the last 18 months. They’ve started experimenting with other automated strategies across lending and AMM protocols as well.

I think this is a huge opportunity for platforms looking for a differentiating service in an increasingly crowded space. If an exchange offered a service like this, I would sign up tomorrow, and pay for it. You can even structure it as a monthly subscription. From a platform’s standpoint, this is gold. Subscription services translate to recurring revenue, and recurring revenue means higher company valuations.

Executing on this strategy means having full visibility into an investor’s portfolio, across centralized and decentralized platforms. Interestingly, the companies with the most visibility into an investor’s portfolio today are tax platforms like Cointracker. Tax platforms have the most complete picture of an investor’s portfolio by virtue of them connecting their exchange accounts and wallets to the platform to track gains and losses.

I wonder if exchanges will recognize this and either (a) start acquiring existing tax platforms, or (b) build their own with the intention of using that data to provide higher margin products and services back to their users (fyi, Credit Karma did the same thing with its free tax prep service).

Parting Thoughts

After writing this article, I’m more optimistic and comfortable with the proposition of people “being their own bank”. I’m also more convinced that to do it successfully, people need more tools and insights at their disposal, helping them make decisions.

Which platform(s) will offer these tools and insights? Do they even exist yet?

Thanks for reading,

Andy

Not a subscriber? Sign up below to receive a new issue every Sunday!